ACCESS HOLDINGS PLC SECURES REGULATORY APPROVALS FOR RIGHTS ISSUE, POSITIONS BANKING SUBSIDIARY FOR GROWTH

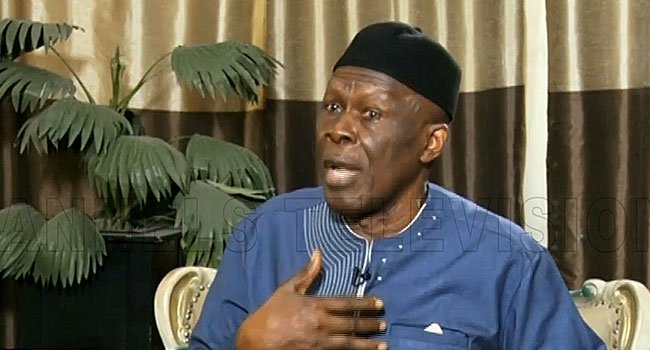

Access Holdings Plc has secured full regulatory approvals from the Central Bank of Nigeria and the Securities and Exchange Commission for its recently closed Rights Issue of 17,772,612,811 Ordinary Shares. As contained in a statement signed by the Company Secretary, Sunday Ekwochi, the successful Rights Issue has raised N351,009,103,017.25, positioning the Company’s flagship subsidiary, Access Bank Plc, to exceed the Central Bank of Nigeria’s N500 billion minimum capital requirements for Banks with International Authorisation. With this development, Access Bank Plc becomes the first bank to meet this regulatory requirement ahead of the March 2026 deadline. The Bank’s share capital will increase to N600 billion, surpassing the regulatory minimum requirement by N100 billion. Access Holdings Plc is also the first CBN-licensed and regulated Financial Holding Company to successfully execute a fully digital Rights Issue, leveraging the NGX’s E-offer platform to provide a seamless and efficient subscription experience for its shareholders. Commenting on the successful offer, the Holding Company’s Chairman, Aigboje Aig-Imoukhuede, CFR, said: “The Access brand has always resonated strongly with the local and international capital markets… The success of the Rights Issue demonstrates the resilience of Nigeria’s capital market and reinforces our shareholders’ confidence in the present value and potential of our Company.” He expressed gratitude to the Central Bank of Nigeria, the Securities and Exchange Commission, and the Company’s valued shareholders for their support.