CBN: NAVIGATING THE PROCESS FOR MONETARY STABILITY

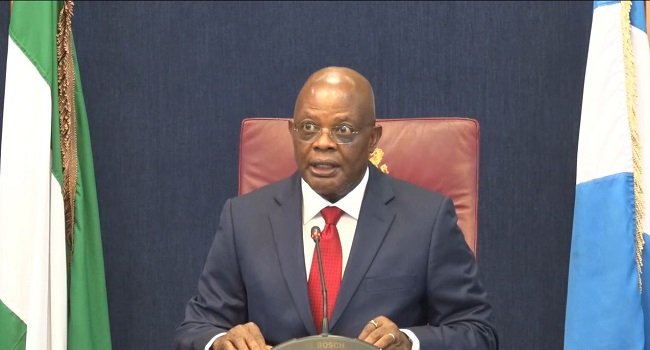

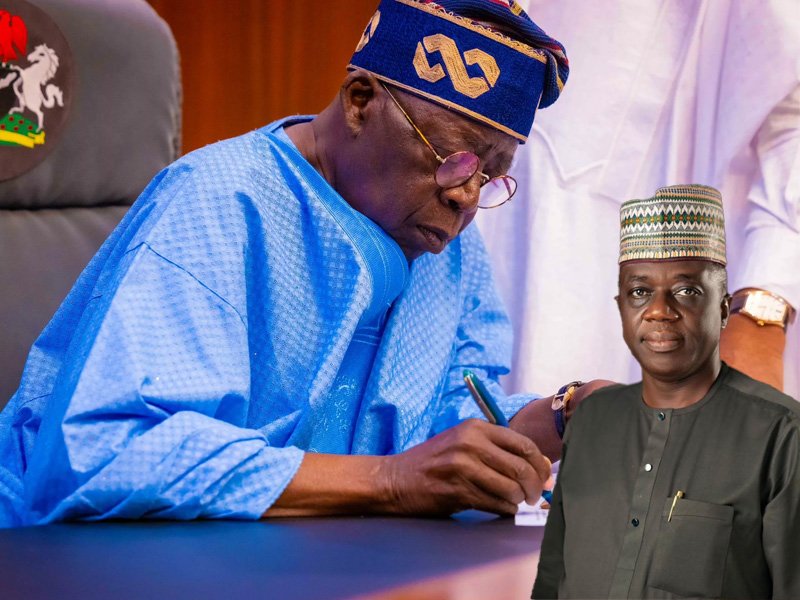

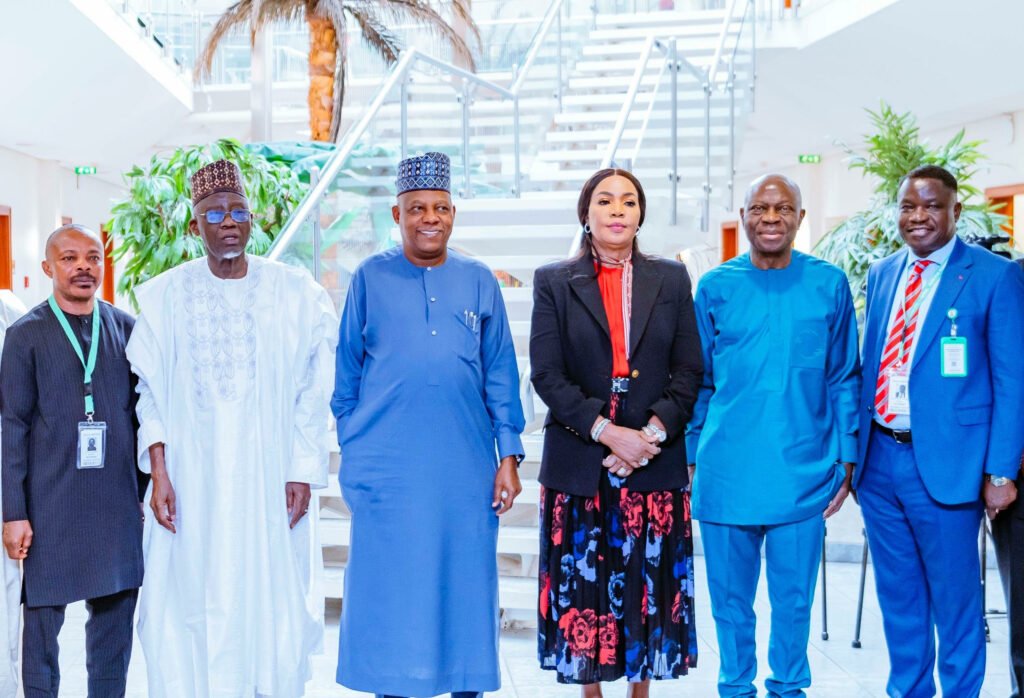

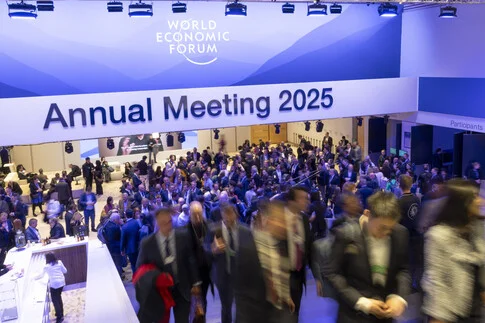

By IBRAHIM MODIBBO.Ph.D The 2025 Monetary Policy Forum, declared open by the Governor of the Central Bank of Nigeria (CBN), Olayemi Cardoso, reinforces the apex bank’s price stability and macro-economic reforms. The theme: “Managing the disinflation process” resonates with the nation’s current economic realities, where inflationary pressures persist amid global and domestic shocks. The governor’s remarks reflect a balanced mix of optimism, pragmatism, and a forward-looking approach to monetary policy.His speech emphasizes the CBN’s strategic measures in taming inflation, restoring foreign exchange stability, and implementing financial sector reforms that position Nigeria for sustainable economic growth. Cardoso framed the forum as an essential intellectual platform for examining monetary policy challenges with precision. Unlike broader economic conferences, this event fosters evidence based discussions that shape policy direction. In emphasizing the need for clear communication, he acknowledges the critical role of transparency and stakeholder engagement in building confidence in monetary policy decisions. This emphasis on dialogue is significant, particularly as monetary policy remains a powerful yet complex tool requiring careful calibration. A major takeaway from the governor’s speech is his review of the economic landscape over the past year. Nigeria has faced persistent inflationary pressures, driven by both structural challenges and monetary dynamics. As at December 2024, headline inflation stood at 34.80% with core inflation, remaining a major concern despite some moderation in food inflation. The governor rightly points to domestic structural bottlenecks, exchange rate pass through effects, and energy price adjustments as factors exacerbating inflationary trends.While acknowledging these supply-side constraints, he also recognizes the role of past liquidity injections in fueling demand driven inflation. This candid assessment is crucial in understanding Nigeria’s inflationary progression, as it highlights the multifaceted nature of the challenge. The governor’s remarks on liquidity injections and their unintended consequences reflect an awareness of policy trade-offs. He notes that unorthodox monetary interventions, particularly in response to the COVID-19 pandemic, led to an excess liquidity overhang that did not translate into productive growth. The resulting inflationary pressures and exchange rate volatility necessitated a shift towards a more disciplined and coordinated monetary policy approach. This shift is evident in the Monetary Policy Committee’s (MPC) tightening cycle, which saw the Monetary Policy Rate (MPR) rise by a cumulative 875 basis points to 27.50% in 2024. Similarly, the Cash Reserve Ratio (CRR) for Other Depository Corporations (ODCs) was raised by 1,750 basis points to 50.00%, a bold move aimed at mopping up excess liquidity. These decisive interventions, the governor argues, were necessary to prevent inflation from spiralling further. Counter-factual estimates suggest that without such measures, inflation could have surged to 42.81% by the end of 2024. This assertion stresses the importance of proactive policy responses in mitigating economic distortions. The commitment to tightening reflects the CBN’s resolve to anchor inflation expectations while ensuring that monetary policy remains an effective tool for economic stability. Beyond inflation control, the CBN has implemented critical financial sector reforms to strengthen Nigeria’s economic resilience. The unification of multiple exchange rate windows has improved efficiency in the foreign exchange market, leading to a notable increase in remittances through International Money Transfer Operators (IMTOs). The governor cites a 79.44% rise in remittances to 4.18 billion in the first three quarters of 2024, compared to 2.33 billion in the same period of 2023. This reform, alongside the clearance of a $7.0 billion backlog of FX commitments, has bolstered market confidence and enhanced liquidity with rising external reserves of $ 40 billion as of Decembe 2024. Another significant policy shift is the lifting of restrictions on 41 items previously banned from accessing the official FX market. The reversal of this 2015 policy signals a more market-driven approach aimed at improving supply side dynamics.Additionally, the introduction of new minimum capital requirements for banks, effective by March 2026, is a forward-thinking measure designed to strengthen the financial system’s resilience. By ensuring that banks are adequately capitalized, this policy aligns with Nigeria’s ambition of becoming a 1 trillion economy, reinforcing the stability and global competitiveness of the banking sector.The governor also showcases the launch of the Women’s Financial Inclusion Initiative (WIFI) under the National Financial Inclusion Strategy. This initiative addresses gender disparities in financial access, empowering women through digital tools, education, and financial services. Inclusive finance remains a key pillar of sustainable economic development, and the CBN’s focus on bridging financial gaps reflects a broader commitment to equitable growth. In a further effort to instill transparency and efficiency in the FX market, the CBN recently introduced the Nigeria Foreign Exchange Code. This framework, built on six core principles, aims to enhance integrity, fairness, and trust within the financial ecosystem. Such measures are essential in attracting foreign investment and maintaining confidence in Nigeria’s economic reforms. Cardoso’s speech also contextualizes Nigeria’s disinflation efforts within the global monetary landscape. He acknowledges emerging optimism regarding potential improvements in capital flows to emerging markets, particularly as advanced economies transition toward monetary easing. However, he cautions that Nigeria’s ability to attract these inflows hinges on investor confidence in domestic reforms. The need to deliver positive real returns on investment accentuates the importance of maintaining macroeconomic stability and ensuring that inflationary trends do not erode gains. Looking ahead, the governor stresses that the shift from unorthodox to orthodox monetary policy is crucial for restoring confidence and strengthening policy credibility. Encouragingly, early signs of progress are evident. FX liquidity is improving, and the naira is gradually aligning with market fundamentals, creating a more predictable environment for economic activities. While acknowledging that challenges remain, Cardoso expresses confidence that Nigeria’s policies are setting the stage for sustainable economic stability. The call for collaboration is another vital point in his remarks. Managing disinflation requires coordinated efforts between monetary and fiscal authorities, alongside active engagement with the private sector and civil society. This alignment is necessary to anchor inflation expectations, maintain investor confidence, and ensure that economic policies translate into tangible benefits for Nigerians.The governor reiterated the importance of a forward-looking, adaptive, and resilient monetary policy framework. By prioritizing price stability, financial sector resilience, and macro-economic