NNPC SHUTS DOWN PORT HARCOURT REFINERY FOR SCHEDULED MAINTENANCE

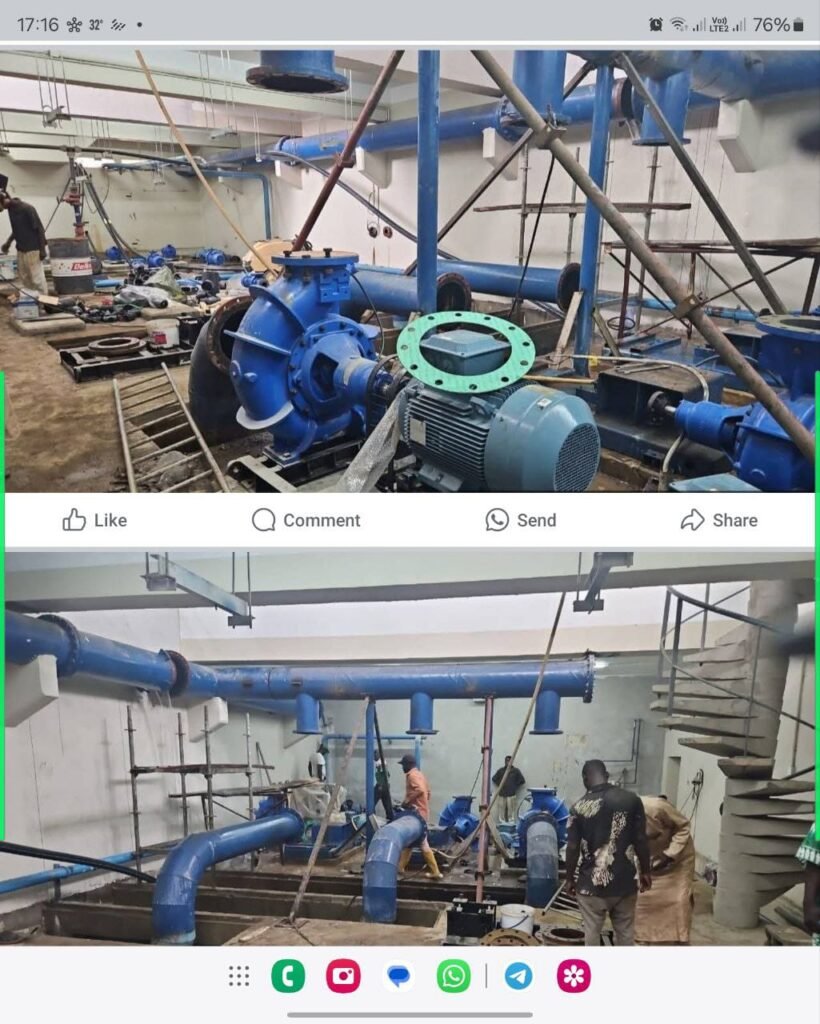

The Nigerian National Petroleum Company Limited (NNPC Ltd) has announced the immediate shutdown of operations at the Port Harcourt Refining Company (PHRC) as part of a scheduled maintenance exercise. The development was confirmed in a statement released by the Chief Corporate Communications Officer, Femi Soneye. “The Nigerian National Petroleum Company Limited (NNPC Ltd) wishes to inform the general public that the Port Harcourt Refining Company (PHRC) will undergo a planned maintenance shutdown,” the statement read. “This scheduled maintenance and sustainability assessment will commence on May 24, 2025.” According to NNPC Ltd, the maintenance is aimed at enhancing the refinery’s performance and ensuring long-term operational sustainability. The company is working closely with all relevant stakeholders, including the Nigerian Midstream and Downstream Petroleum Regulatory Authority (NMDPRA), to ensure the maintenance and assessment activities are carried out efficiently and transparently. “NNPC Ltd remains steadfast in its commitment to delivering sustainable energy security,” the statement added. The company assured that regular updates will be provided through official channels, including its website and media platforms, to keep the public informed throughout the maintenance period. This is not the first time the Port Harcourt refinery has been shut down, as it was previously shut down in December 2024, shortly after operations resumed following a $1.5 billion rehabilitation exercise.