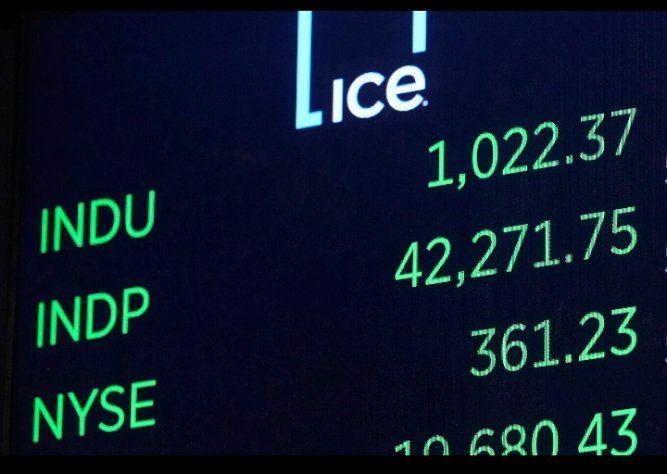

STOCK MARKET SURGES AS US-CHINA ANNOUNCE A 90-DAY TRADE TRUCE

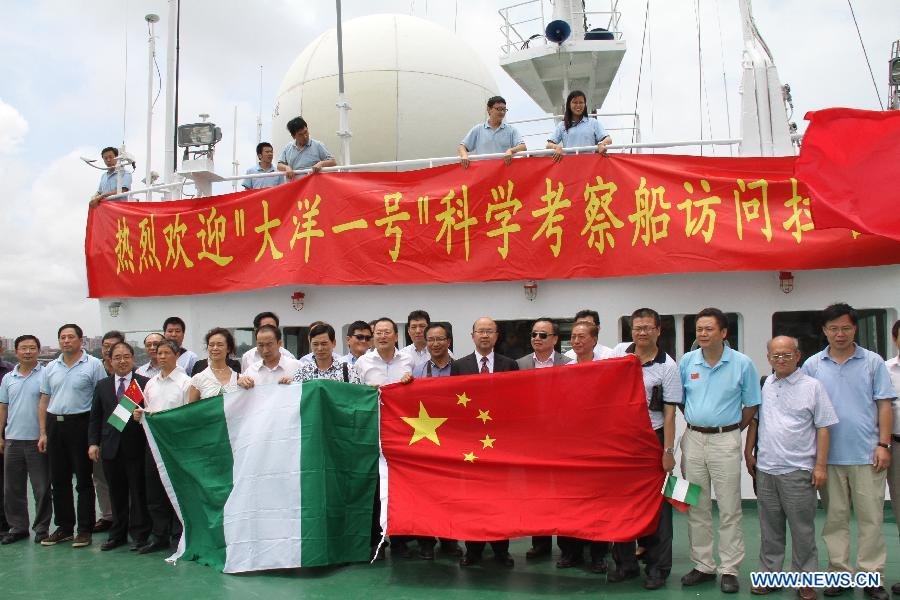

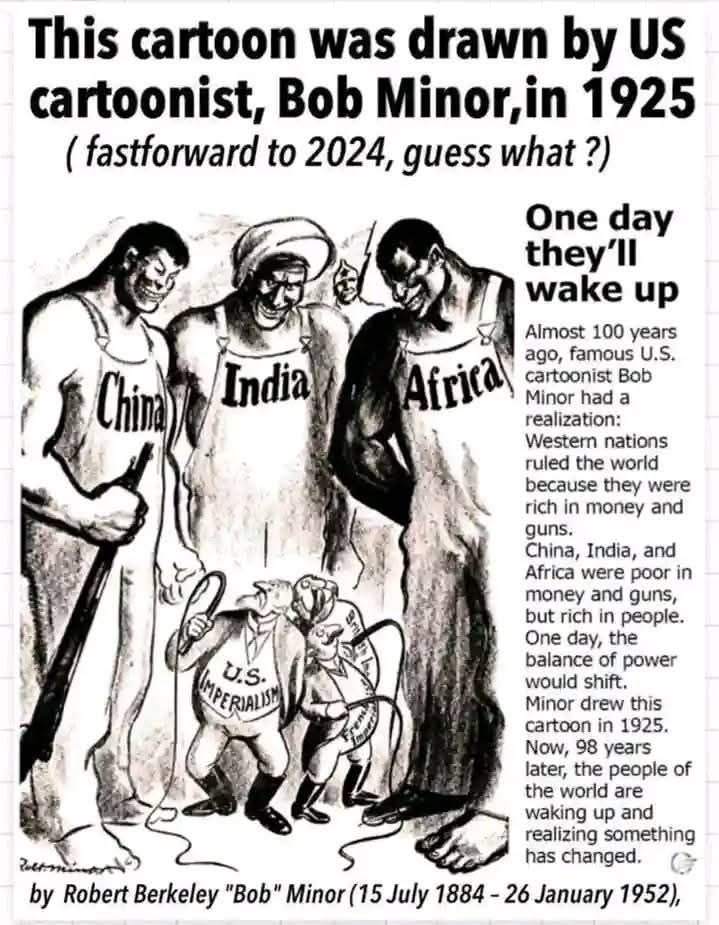

US stocks surged on Monday after China and the United States announced a 90-day truce in their trade war, agreeing to reduce tariffs that economists warned could lead to a recession and shortages on US store shelves. The S&P 500 jumped 2.6% in early trading, bringing it within 5.5% of its all-time high set in February. The agreement follows substantial progress in negotiations between the two countries in Geneva, Switzerland, over the weekend. As part of the deal, the US will cut tariffs on Chinese goods to 30% from as high as 145%, while China will reduce its tariffs on US goods to 10% from 125%. This move comes after the US announced a similar deal with the United Kingdom last week, which will bring down tariffs on many UK imports to 10%. The truce had an immediate impact on the markets, with crude oil prices rising over 3% due to expectations of increased fuel demand in a global economy less weakened by tariffs. The value of the dollar climbed against major currencies, including the euro, Japanese yen, and Swiss franc. Treasury yields also increased, with the 10-year yield jumping to 4.45% from 4.37% late Friday, and the two-year yield rising to 3.99% from 3.88%. Apparel companies led the gains, with Lululemon surging 10% and Nike rising 7.3%, as investors anticipate reduced production costs. Travel companies also saw significant gains, with Carnival jumping 8.9% and Norwegian Cruise Line rising 8%, on hopes that lower tariffs will boost customer spending on trips. Retailers like Best Buy and Amazon rose at least 7%, as they won’t have to pass on high costs caused by tariffs to their customers. International stock markets also reacted positively, with India’s Sensex shooting up 3.7% after India and Pakistan agreed to a truce following talks to defuse their military confrontation. Pakistan’s KSE 100 surged over 9%, with trading halted for an hour due to the spike driven by the ceasefire and an IMF decision to disburse $1 billion of a bailout package for its economy.