FG SET TO REMOVE ELECTRICITY SUBSIDY, NIGERIANS TO FACE HIGHER TARIFFS

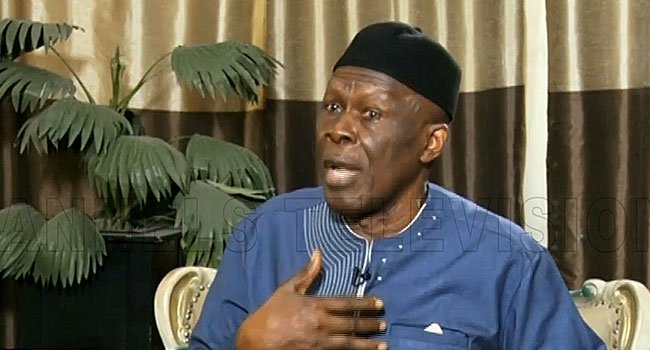

The Federal Government has announced plans to remove electricity subsidies, warning Nigerians to prepare for higher tariffs. Minister of Power, Adebayo Adelabu, stated that the country’s economy can no longer sustain subsidies, emphasizing that “our economy cannot sustain subsidies indefinitely.” Adelabu made this declaration at a meeting with the Chairmen of Nigeria’s Generating Companies (Gencos) in Abuja, where he also highlighted the government’s commitment to providing targeted subsidies for economically disadvantaged Nigerians. “Citizens must pay the appropriate price for the energy consumed. The Federal Government will continue to provide targeted subsidies for economically disadvantaged Nigerians,” Adelabu said. The move is aimed at addressing the N4 trillion debt owed to Gencos, which has been hindering power generation in the country. Adelabu outlined a plan to settle the debt using a combination of cash payments and financial instruments like promissory notes. “There is a need to pay a substantial amount of the debt in cash. At the minimum, let us pay a substantial amount, then ask for a debt instrument in promissory notes to pay the rest,” he explained. According to the Nigerian Electricity Regulatory Commission (NERC), the average real tariff stands at N116.18 per kilowatt-hour, while consumers are currently charged N88.2 per kilowatt-hour. The subsidy cost per kilowatt-hour is represented by the gap between the real tariff and the average collection, which amounted to N27.97 kWh in February. All NESI customers, except for the 15% classified as Band A, benefit from a subsidy. The government’s decision to remove electricity subsidies has sparked concerns about the impact on Nigerians already grappling with rising living costs. Adelabu, however, assured that the government is committed to resolving the debt crisis and stabilizing the sector. “We recognise the urgency of this matter. The government is committed to resolving this debt to stabilise the sector and prevent further crisis,” he said.