BANKS TO DEDUCT USSD CHARGES FROM CUSTOMERS’ AIRTIME IN NEW DIRECTIVE

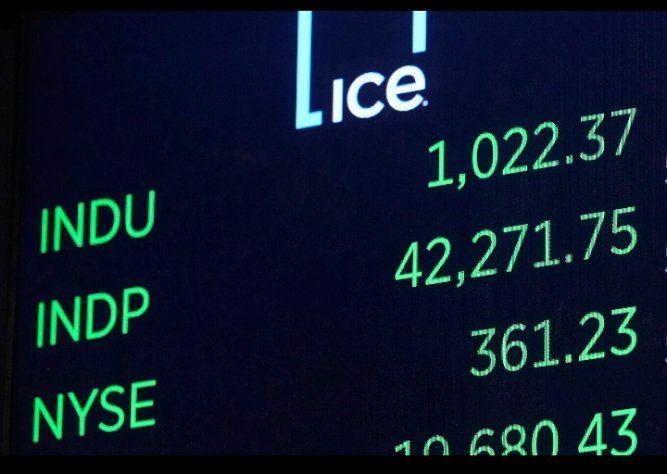

The Nigerian Communications Commission (NCC) has directed Deposit Money Banks to start deducting charges for Unstructured Supplementary Service Data (USSD) transactions directly from customers’ mobile airtime balances. This move comes after years of disputes between banks and telecom operators over unpaid USSD service charges estimated at N250 billion.

United Bank for Africa (UBA) has confirmed compliance with the directive, stating that charges for USSD banking services will no longer be deducted from customers’ bank accounts. Instead, customers will be charged N6.98 per 120 seconds for each USSD session, billed directly by their mobile network operator and deducted from their airtime balance.

According to an NCC official, the new End-User Billing model is designed to bring transparency and accountability to the process, ensuring that telecom operators are paid directly. “It ensures that telcos are paid directly, removing the ambiguity that has stalled settlements in the past,” the official said.

A telecom executive familiar with the matter welcomed the change, saying, “This new system is a win for transparency. For years, we’ve delivered a service and gotten no payment. Billing via airtime ensures payment at the point of use.”

However, concerns have been raised about the impact on financially vulnerable customers. Bola Oke, a financial inclusion expert, warned that requiring airtime may reduce USSD usage among low-income users who depend on the service but may not always have airtime credit. “Many rural and low-income users rely on USSD because they lack smartphones or stable internet. If airtime becomes a barrier, we risk reversing gains in financial inclusion,” Oke said.

Customers using popular USSD codes such as *919# (UBA) and *737# (GTBank) must now ensure they have sufficient airtime to perform transactions. The NCC and Central Bank of Nigeria (CBN) have stated that the move aims to resolve longstanding frictions in the digital payments ecosystem while protecting the interests of all stakeholders.