NIGERIA’S 2025 BUDGET RAISES CONCERNS OVER DEBT SERVICING AND UNDERDEVELOPMENT

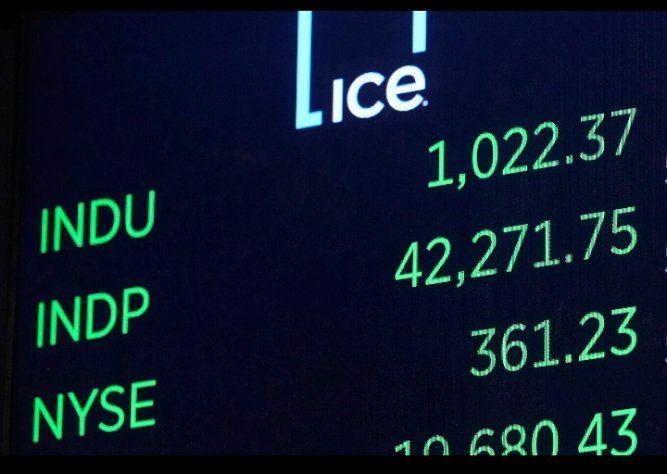

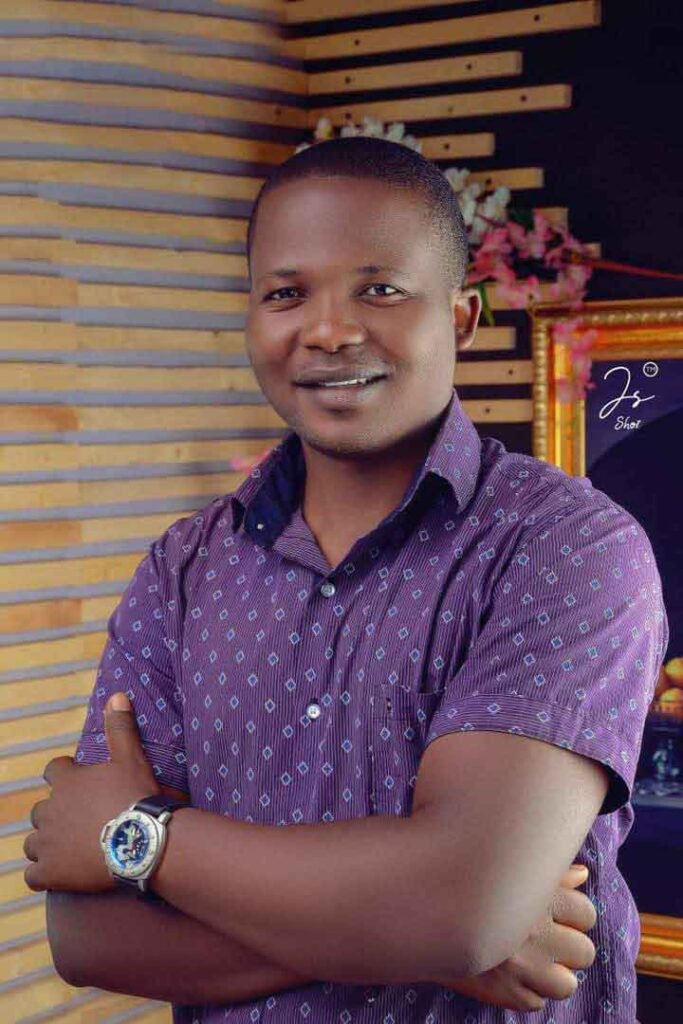

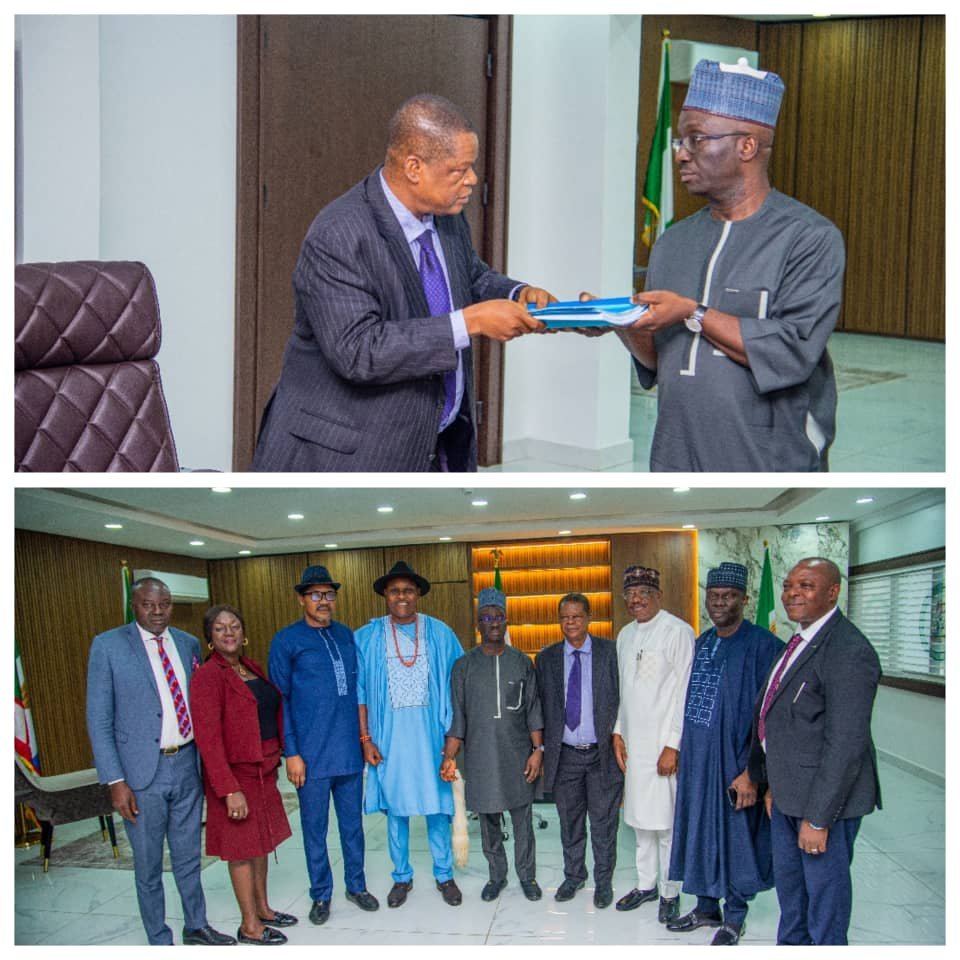

The 2025 Nigerian budget, totaling 49 trillion naira, has raised concerns about the country’s ability to achieve meaningful development. In a statement, the National Secretary of the Coalition of United Political Parties (CUPP), Peter Ameh, expressed concerns about the allocation of resources in the budget.

Peter Ameh noted that the significant allocation of 16 trillion naira, roughly 32% of the total budget, towards debt servicing raises questions about the government’s priorities and its ability to drive economic growth. “The significant amount dedicated to debt servicing suggests that a substantial portion of Nigeria’s revenue will be spent on paying off debts rather than investing in critical sectors like education, healthcare, and infrastructure,” he said.

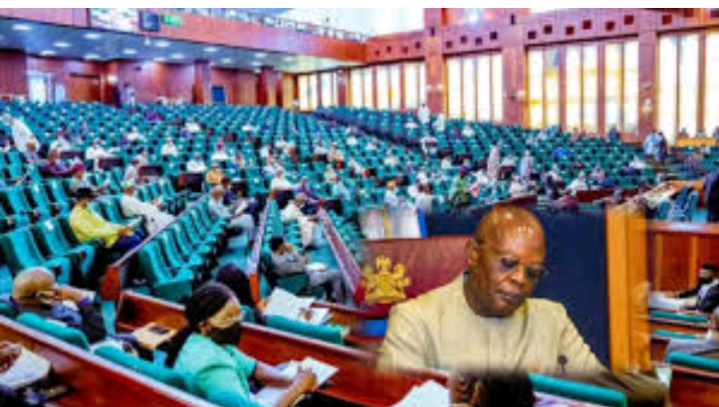

The allocation of funds is particularly concerning given the Minister of Finance’s revelation that the last budget performed poorly, with capital budget implementation standing at only 25% for the 2024 year period. This underperformance raises questions about the government’s ability to effectively implement its budget and drive economic growth. Ameh emphasized that the recurrent expenses, which account for approximately 29% of the total budget, may not have a direct impact on the country’s development.

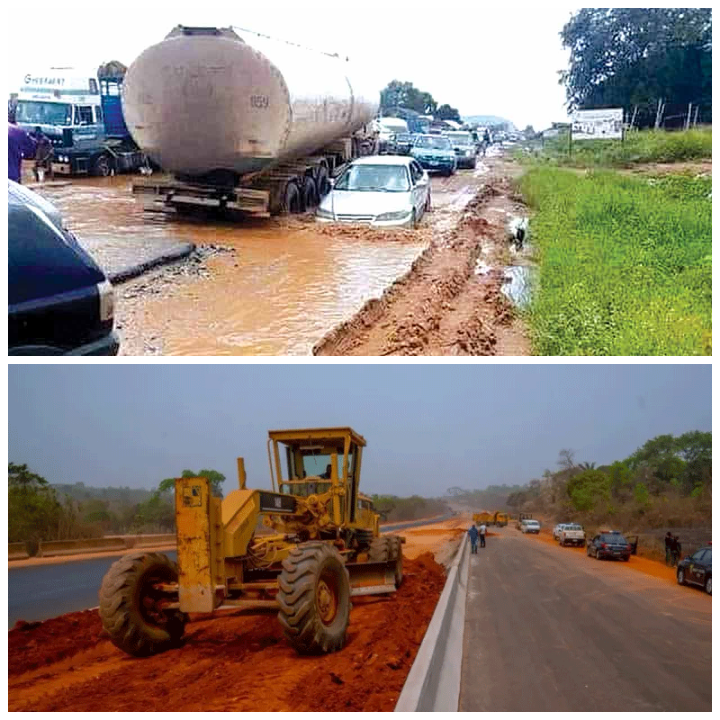

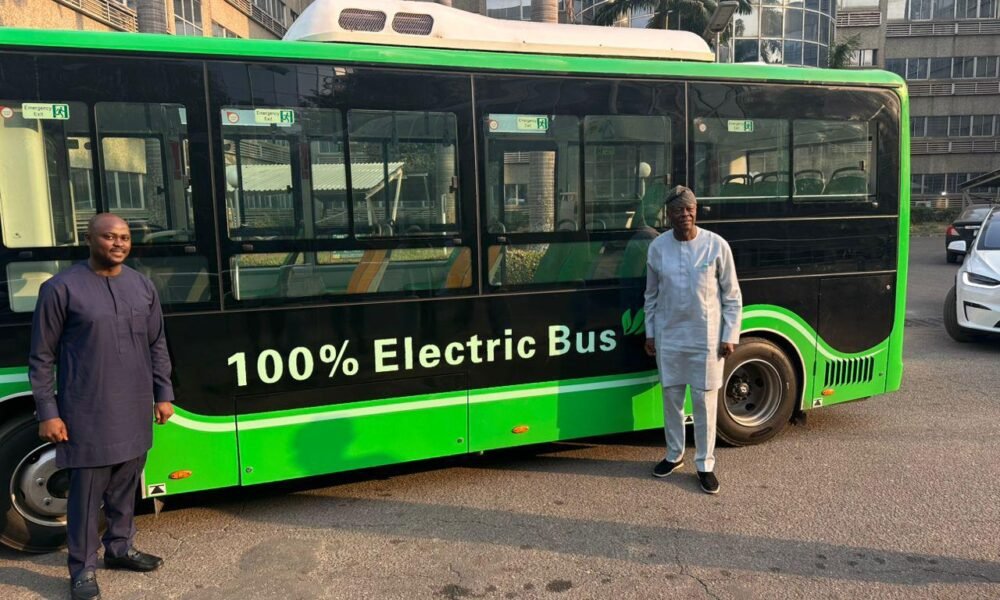

On the other hand, capital projects, which account for around 26% of the total budget, have the potential to drive economic growth and development. However, Ameh noted that the allocation of 13 trillion naira may not be sufficient to address the country’s infrastructure deficits and other development challenges.

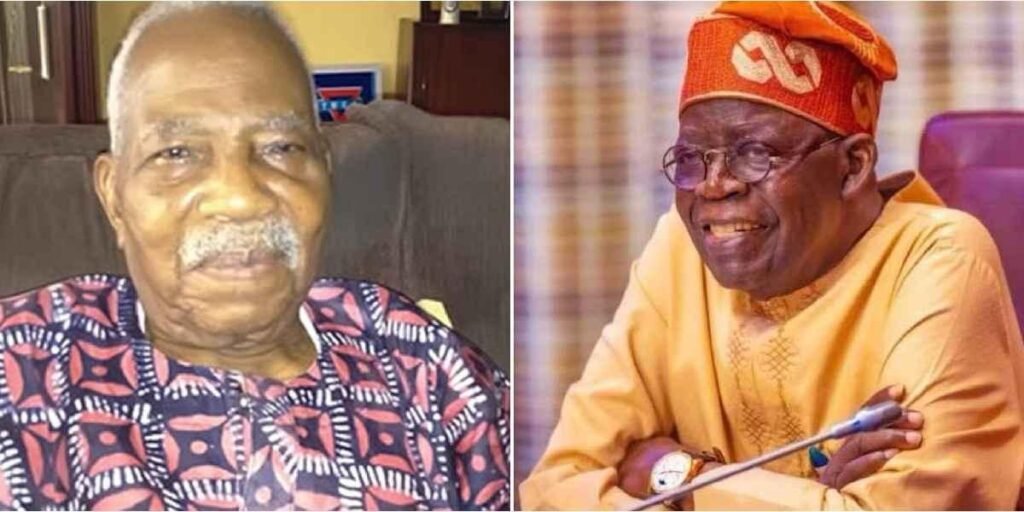

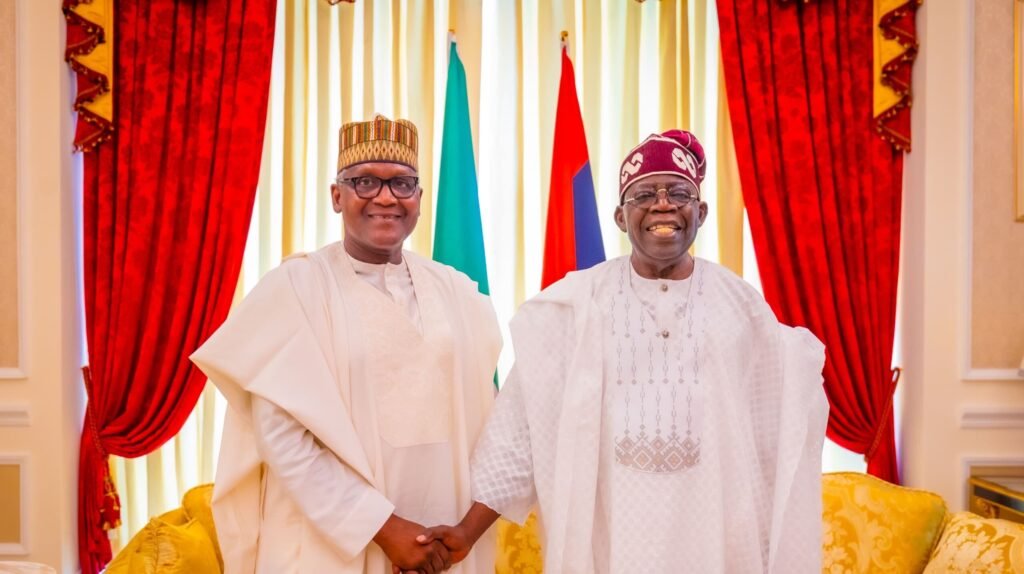

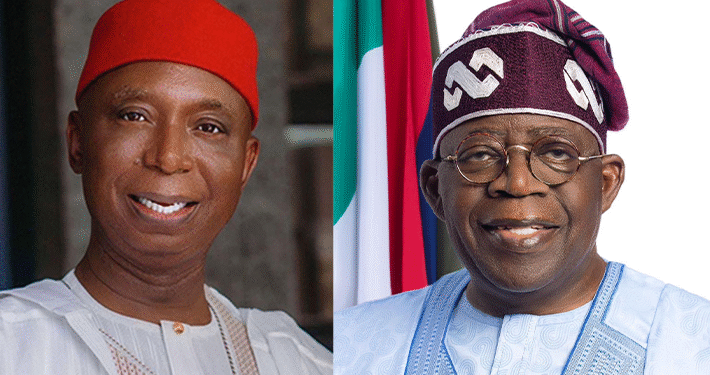

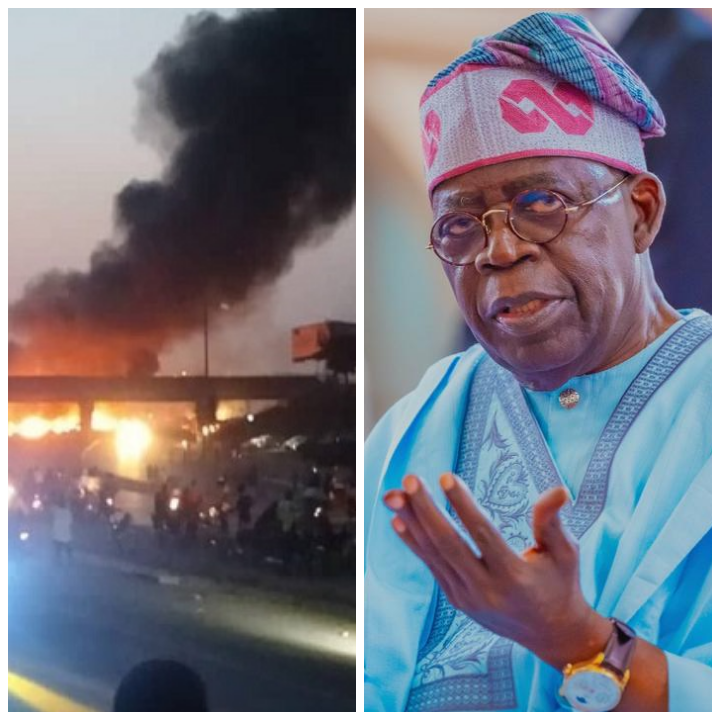

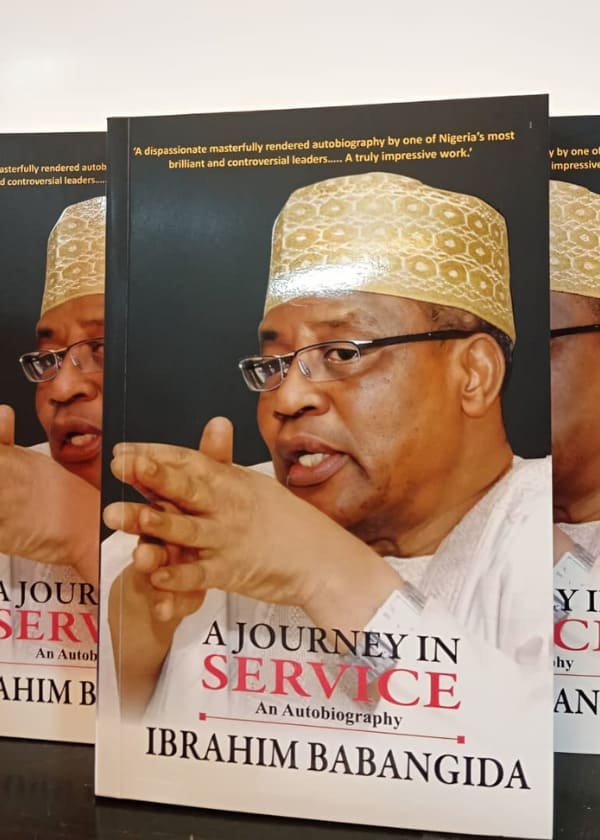

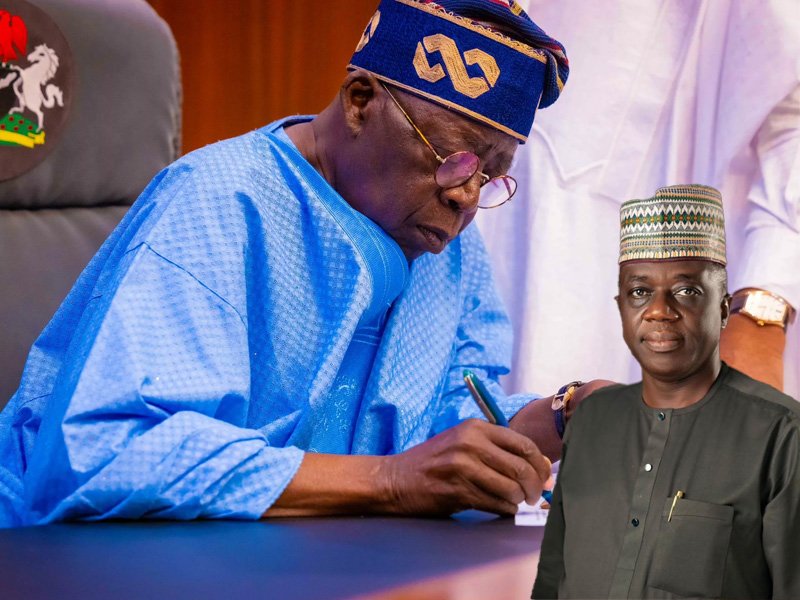

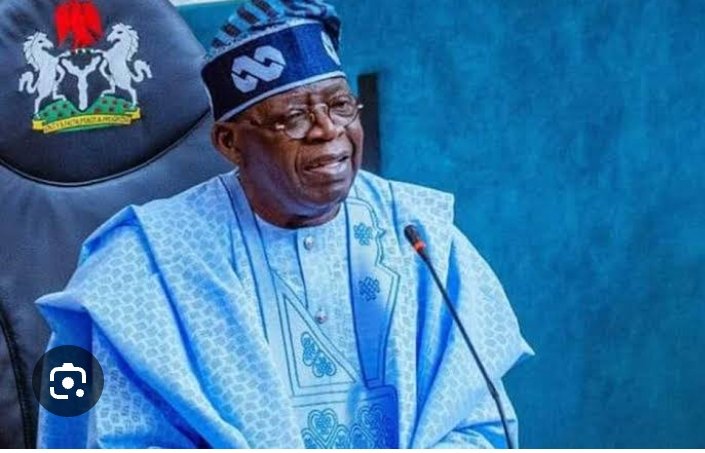

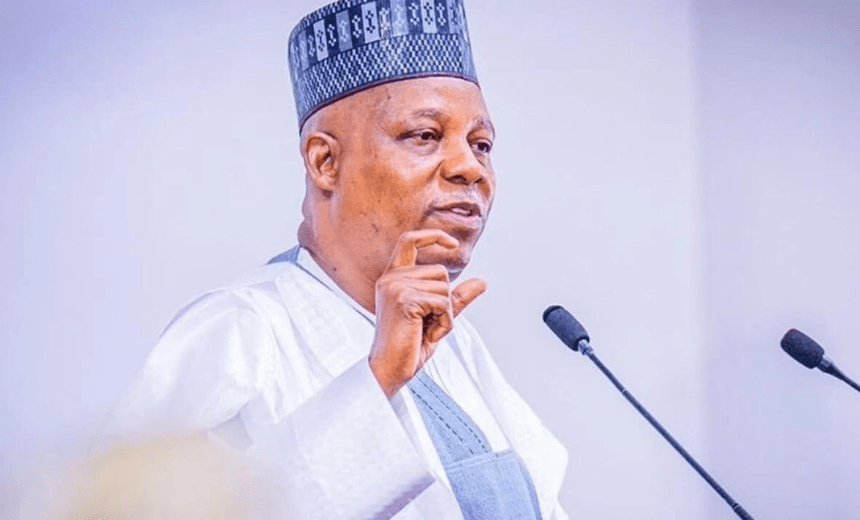

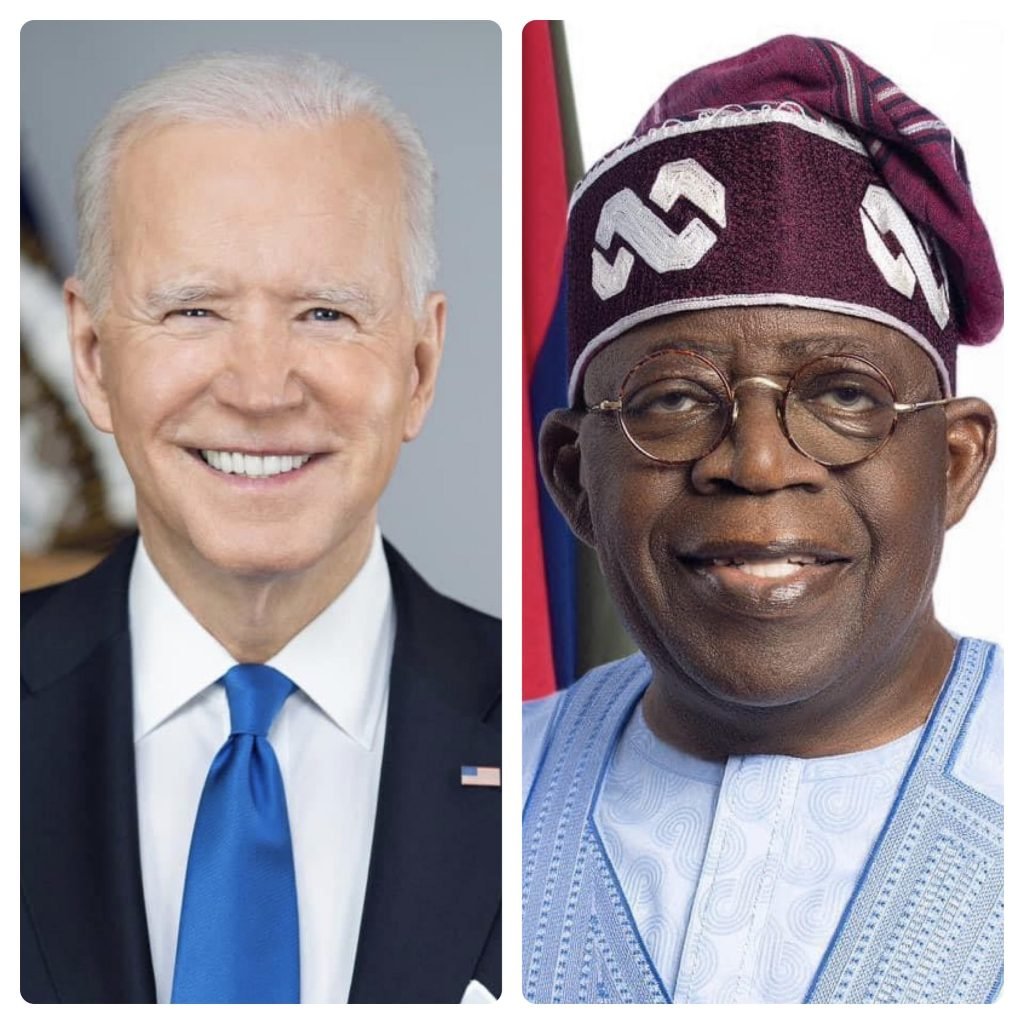

The budget proposal presented by President Bola Ahmed Tinubu highlights key priorities, including defense and security, infrastructure, health, and education. While these allocations are crucial for the country’s development, they may not be sufficient to address the scale of challenges facing Nigeria. The budget also raises concerns about the country’s debt sustainability, with Nigeria’s debt-to-GDP ratio increasing in recent years.