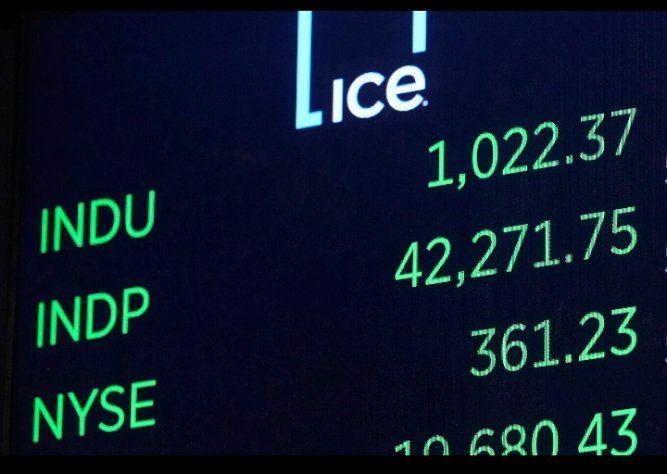

ZENITH BANK PROVIDES CLARIFICATION ON CBN DIRECTIVE, CONFIDENT OF RESUMING DIVIDEND PAYMENTS

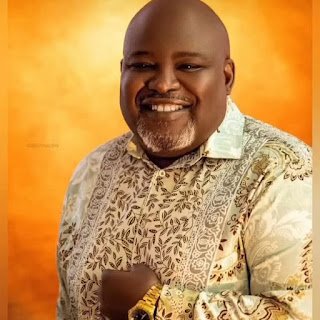

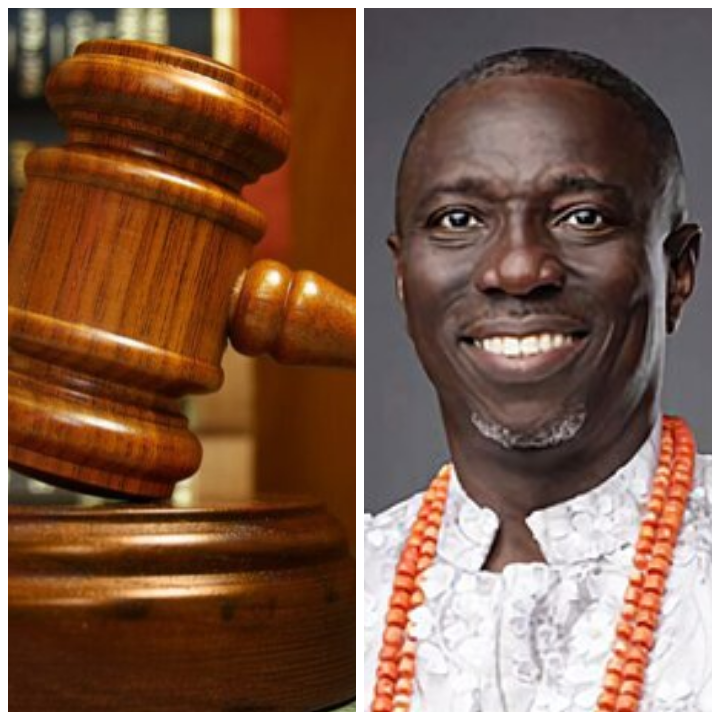

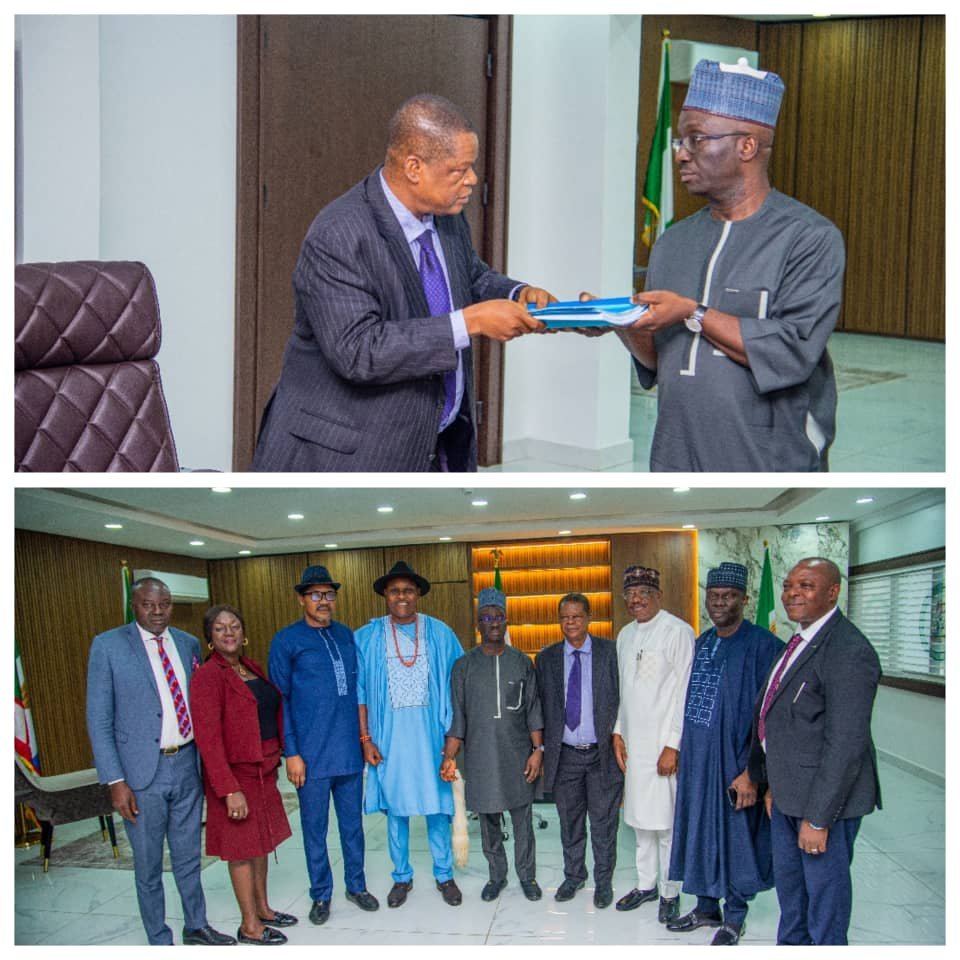

Zenith Bank Plc has provided clarification on the recent Central Bank of Nigeria (CBN) directive suspending dividend payments, bonuses, and investments in foreign subsidiaries for banks under regulatory forbearance. In a statement signed by Company Secretary, Michael O. Otu, the bank assured stakeholders that it is working diligently to exit the forbearance regime. Michael O. Otu stated that Zenith Bank has successfully raised and surpassed the new regulatory capital requirement of N500 billion. The bank’s exposure under the Single Obligor Limit (SOL) forbearance relates to a single obligor, and it is confident that this exposure will be brought within the applicable regulatory limit by June 30, 2025. Otu further explained that the bank’s forbearance on other credit facilities applies to only two customers, with substantial provisions already made and comprehensive steps taken to ensure full provisioning by June 30, 2025. Upon completion, the bank will no longer be under any forbearance arrangements. “We are confident that this exposure will be brought within the applicable regulatory limit on or before June 30, 2025,” Otu said. “We have made substantial provisions in respect of these facilities and have taken appropriate and comprehensive steps to ensure full provisioning by June 30, 2025.” The bank expects to have exited all CBN forbearance arrangements by the end of the first half of 2025 and remains confident that it will satisfy all relevant conditions to enable dividend payments to shareholders in the current year. Otu emphasized the bank’s commitment to meeting regulatory requirements and rewarding shareholders. With this development, Zenith Bank joins other banks in navigating the CBN’s directive aimed at strengthening the banking sector’s capital base and ensuring compliance with prudential standards.