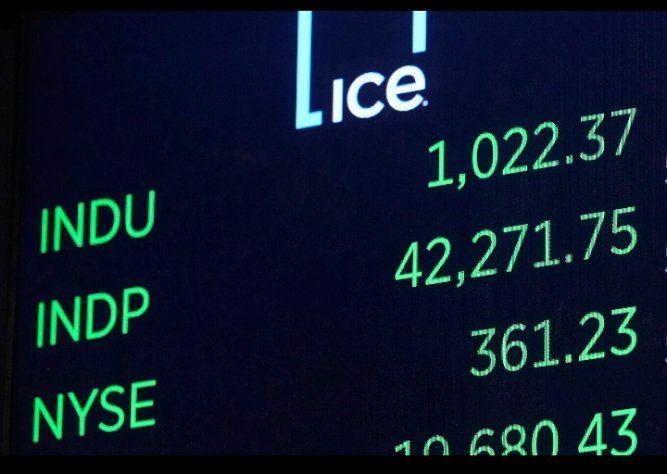

CBN SLAMS N1.35 BILLION FINE ON NINE BANKS FOR CASH SCARCITY DURING FESTIVE SEASON

The Central Bank of Nigeria (CBN) has imposed a fine of N1.35 billion on nine Deposit Money Banks for failing to ensure cash availability through Automated Teller Machines (ATMs) during the festive season. Each bank was fined N150 million for non-compliance with the CBN’s cash distribution guidelines. The affected banks include Fidelity Bank Plc, First Bank Plc, Keystone Bank Plc, Union Bank Plc, Globus Bank Plc, Providus Bank Plc, Zenith Bank Plc, United Bank for Africa Plc, and Sterling Bank Plc. The fines were debited directly from their accounts with the CBN. According to Mrs. Hakama Sidi Ali, Acting Director of Corporate Communications at the CBN, “the regulator remains steadfast in ensuring smooth cash availability.” She reaffirmed the bank’s zero tolerance for disruptions, emphasizing that further sanctions would follow any violations of cash circulation guidelines. The CBN’s enforcement action comes after repeated warnings to financial institutions and reflects the bank’s commitment to addressing cash scarcity. The regulator has also pledged to enhance monitoring and collaborate with security agencies to tackle illegal cash sales and enforce daily withdrawal limits. The CBN’s measures underscore its dedication to prioritizing customer needs and ensuring uninterrupted cash access. As stated by Mrs. Ali, the bank is committed to ensuring that customers have access to cash whenever they need it, and will continue to work towards achieving this goal.