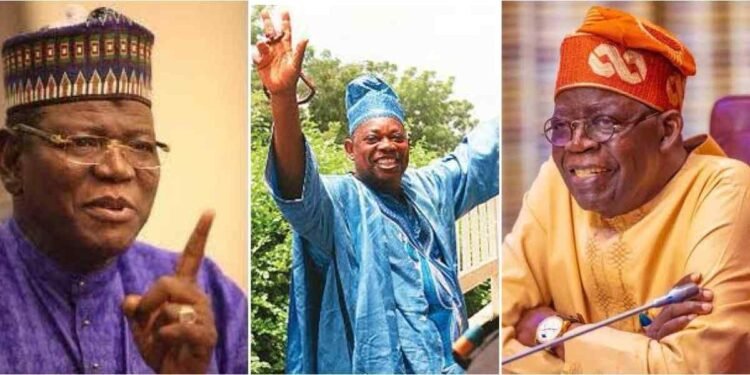

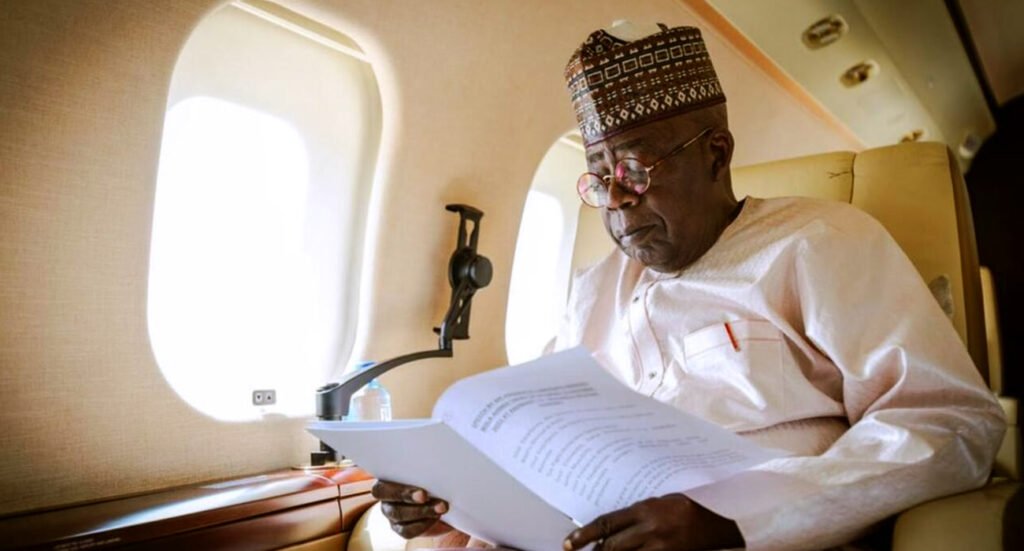

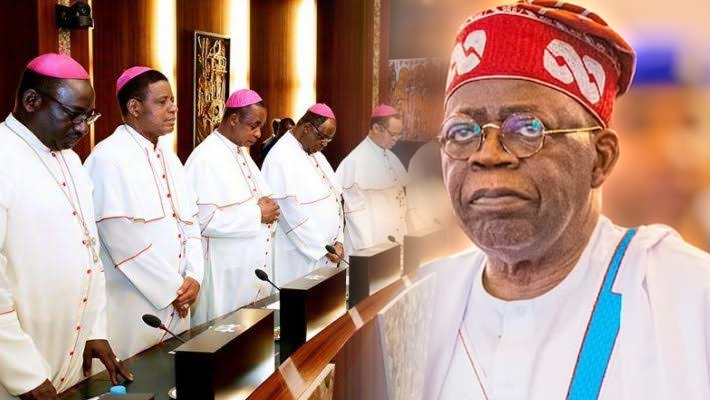

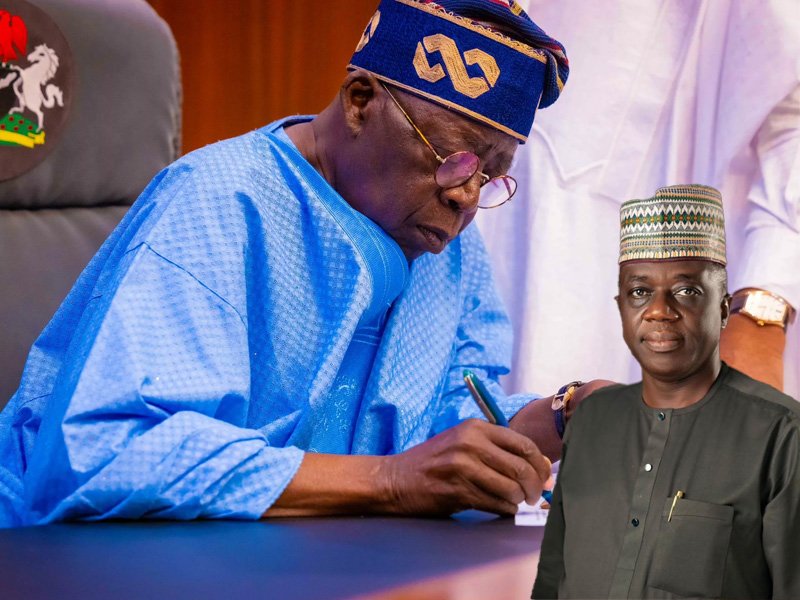

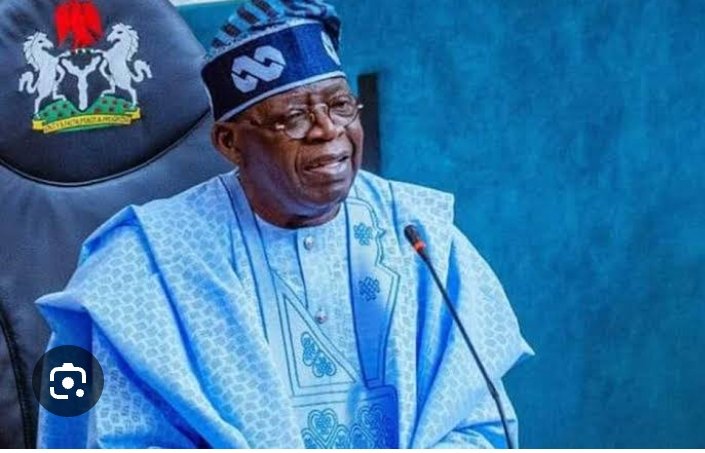

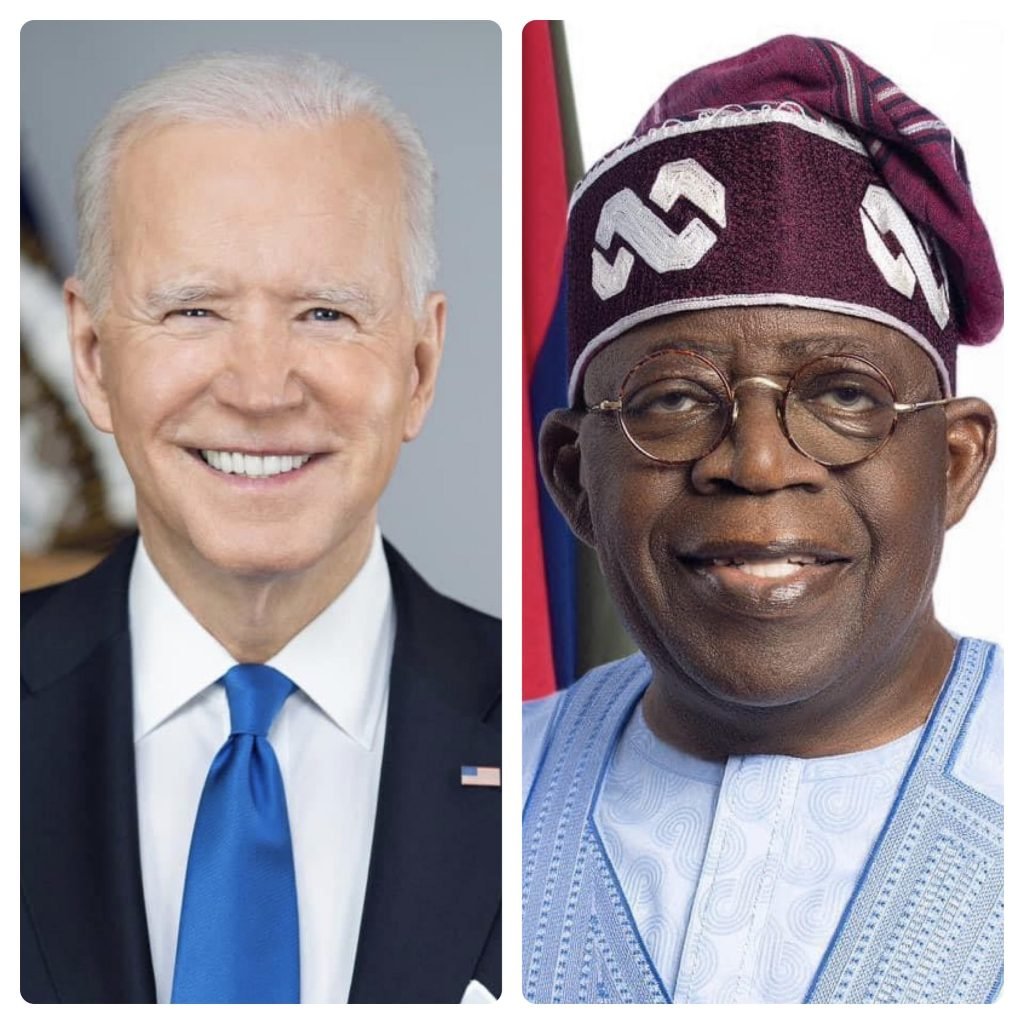

PRESIDENT TINUBU EXPLAINS RATIONALE BEHIND ECONOMIC REFORMS

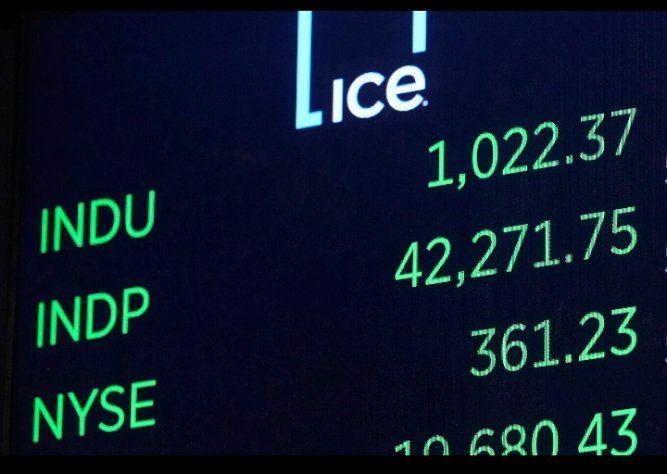

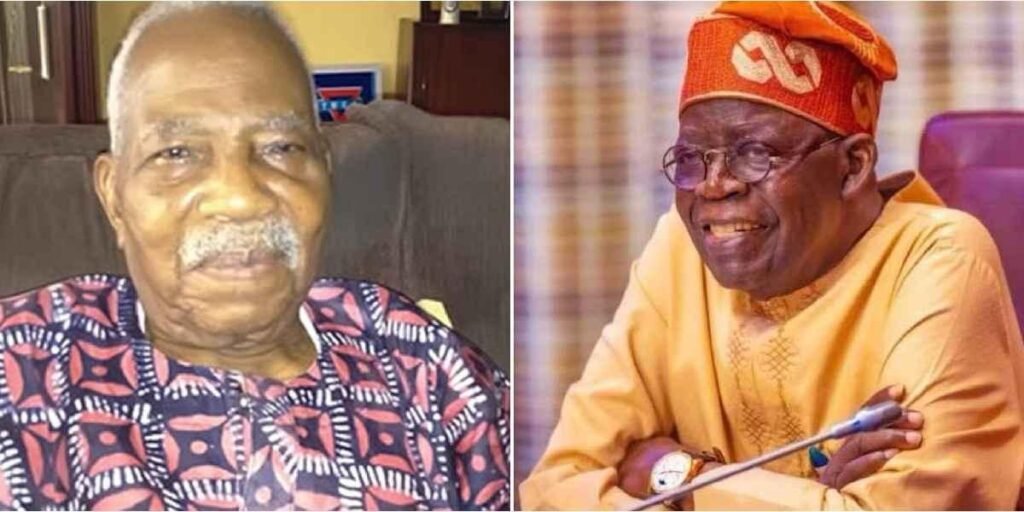

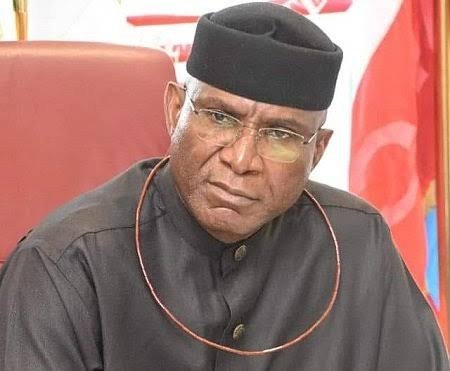

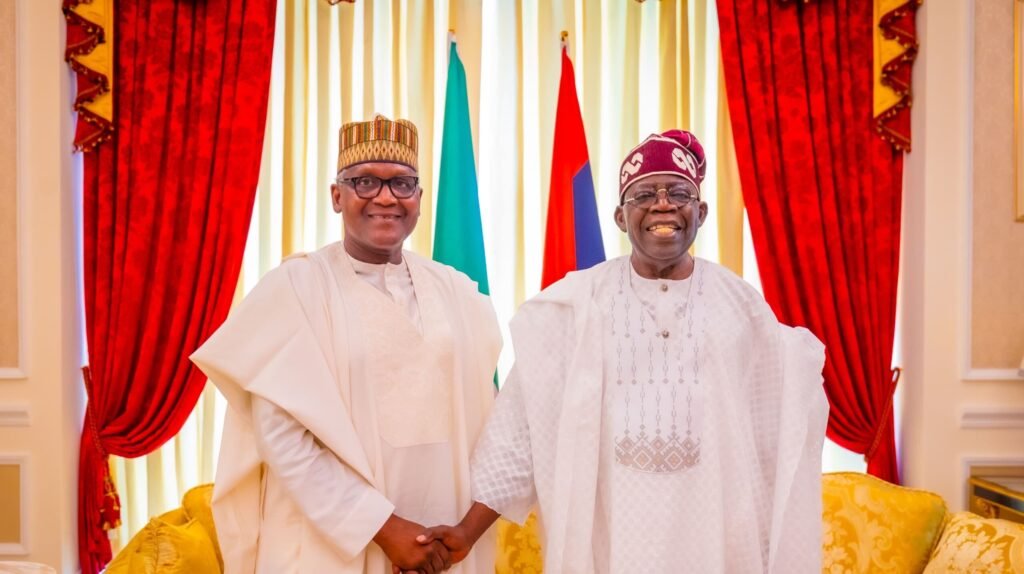

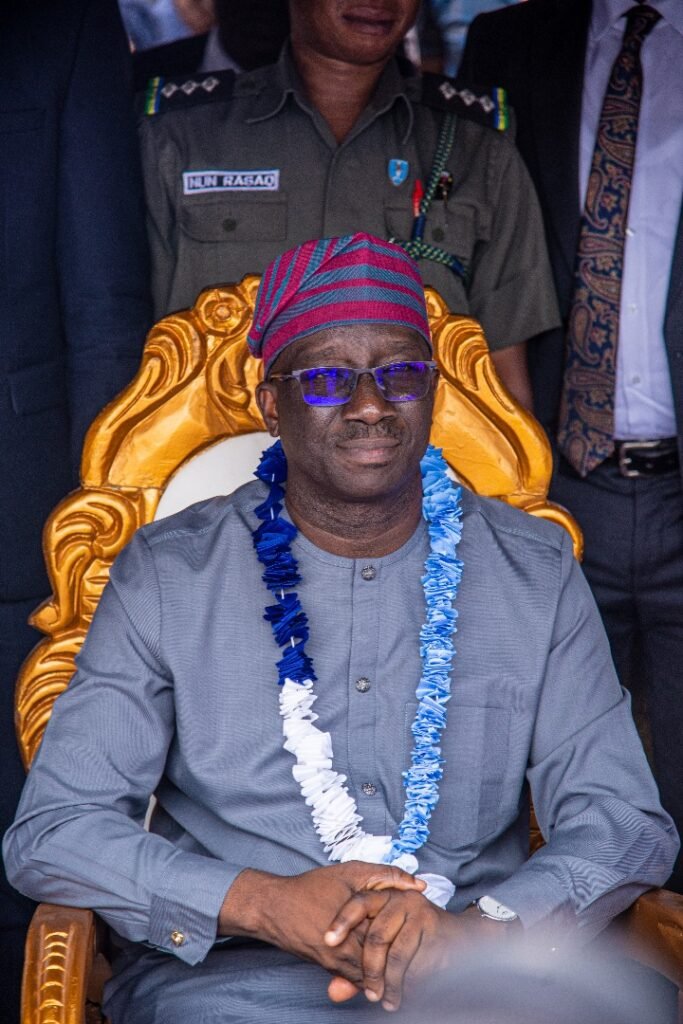

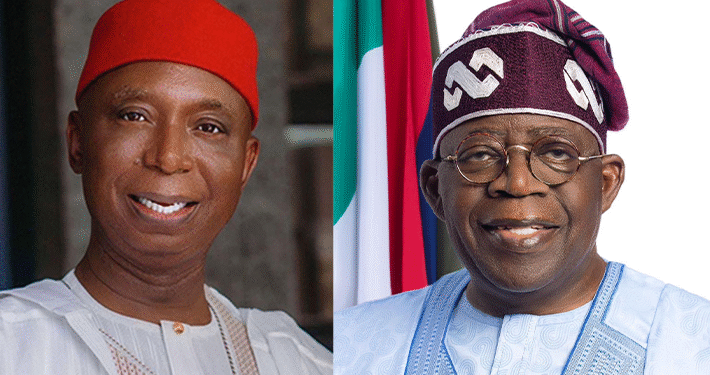

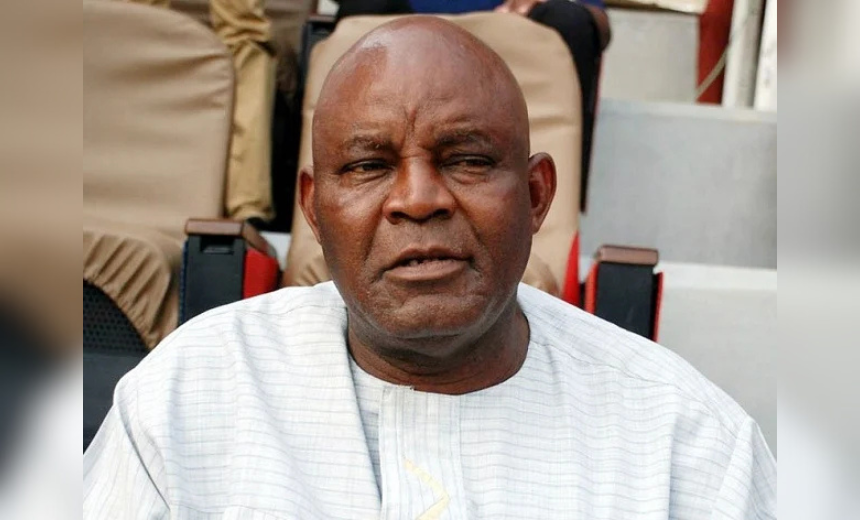

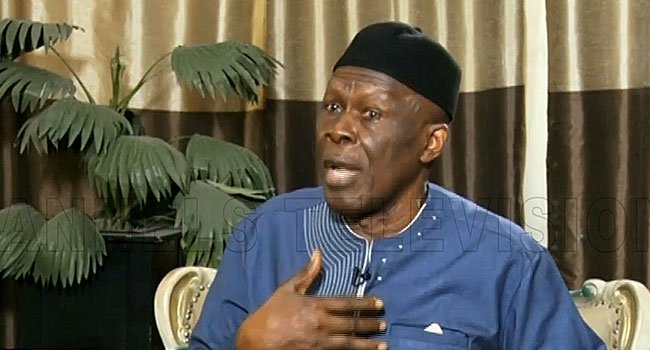

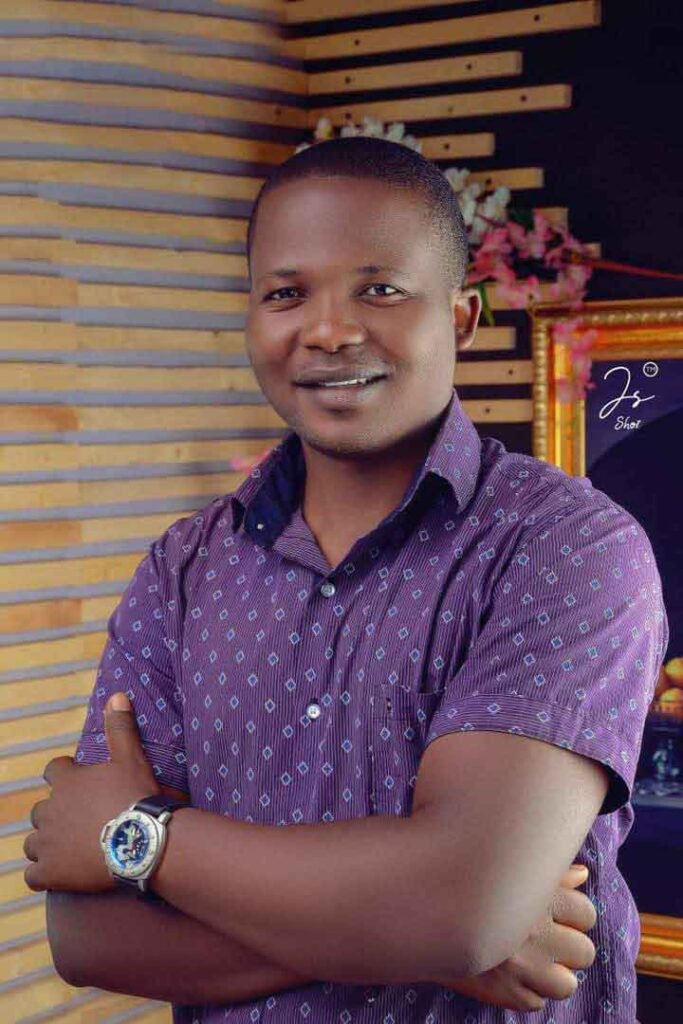

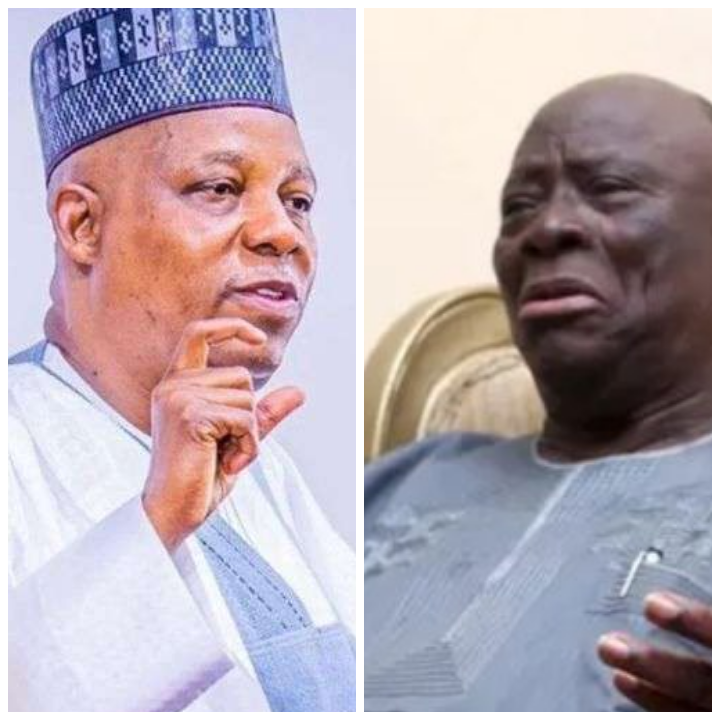

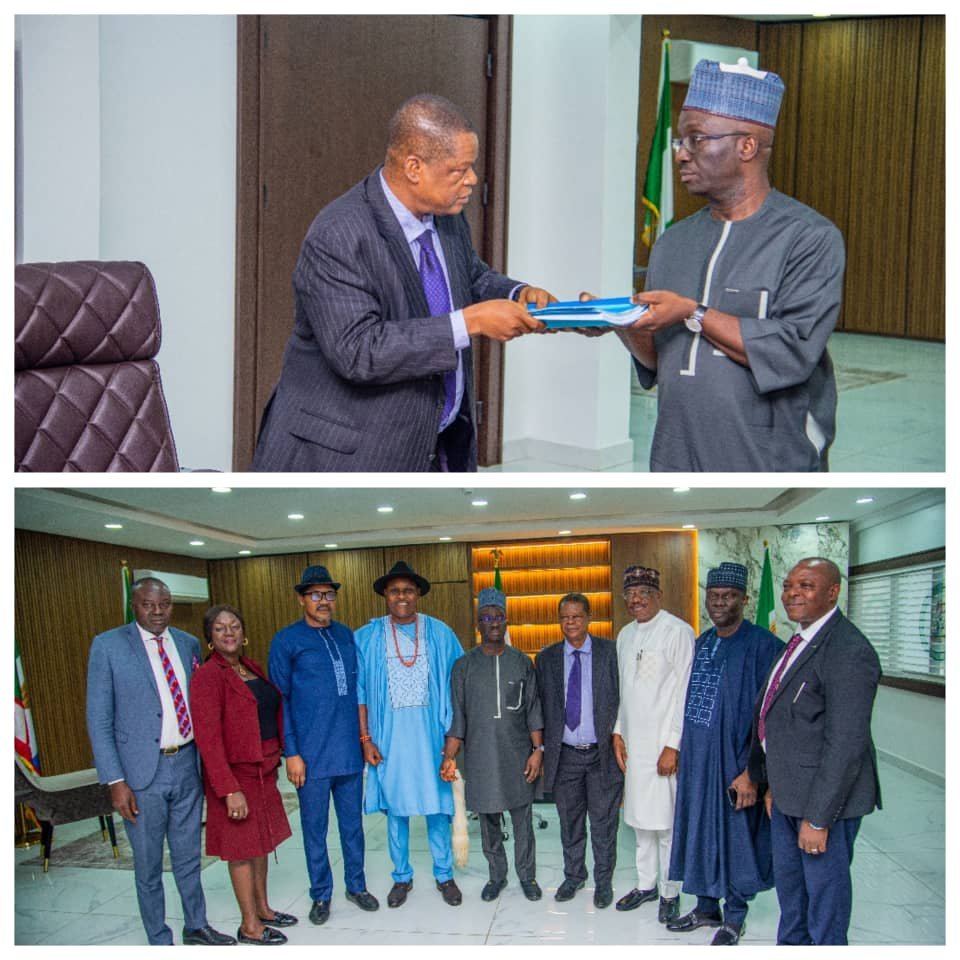

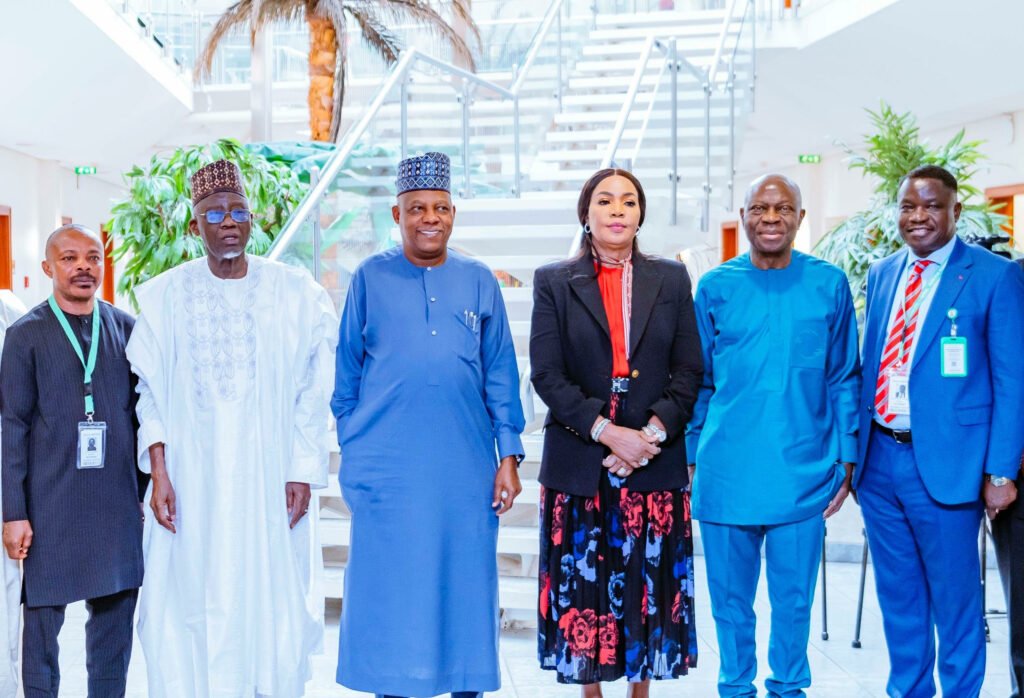

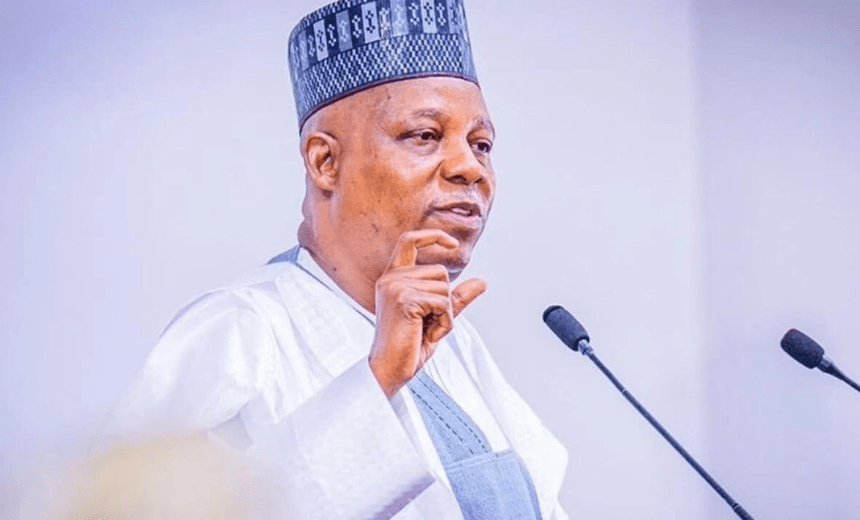

President Bola Ahmed Tinubu has articulated the rationale behind his administration’s economic reforms, saying the primary motive was protecting the interests of future generations. “For 50 years, Nigeria was spending money of generations yet unborn and servicing the West coast of our subregion with fuel. It was getting difficult to plan for our children’s future,” he said. The President made these remarks at the State House in Abuja while receiving a delegation of former National Assembly colleagues from the aborted Third Republic, during which he served as a Senator representing Lagos West. Special Adviser to the President (Information & Strategy), Bayo Onanuga, said in a statement that the President highlighted the challenges faced at the beginning of his administration, especially economic and social issues, and expressed his gratitude for the delegation’s support in addressing these difficulties. President Tinubu declared that the administration had been able to stem the tide and expressed appreciation to Nigerians for their collective support in turning things around. “Today, we are sitting pretty on a good foundation. We have reversed the problem; the Exchange rate is stabilising. Food prices are coming down, especially during Ramadan. We will have light at the end of the tunnel.” Onanuga stated that the President also emphasized the importance of adhering to democratic tenets, saying it is the best route to economic, social, and political development. “I am happy that you are holding to your belief in democracy. I thank you for keeping faith and remembering how we started. Some people missed the ball. Some leadership failed, but we kept the faith with our democratic beliefs and freedom and the right to aspire to the highest office in the land. I am benefitting from it,” President Tinubu said. Senator Emmanuel Chiedoziem Nwaka, who spoke on behalf of the group, expressed his delight at some of the programmes that the Tinubu administration had implemented, especially the Nigerian Education Loan Fund (NELFUND) and the Nigerian Consumer Credit Corporation (CREDICORP). Onanuga stated that Senator Nwaka commended the President for the initiatives, saying, “I appreciate you for what you are giving to students because the student population is the largest demographic in the country. I’ve spoken with many of them, and many have benefited from it. And the next one is the CREDICORP. That’s a major way of fighting corruption. You see a young man, you come out of school, you want to buy a car, you have to put down cash, you want to buy a house, and you are not married, but with the CREDICORP, you can get things done. I’m following their activities; we are delighted.” Other members of the delegation were Sen. Bako Aufara Musa, Hon. Terwase Orbunde, Hon. Wasiu Logun, Hon. Amina Aliyu, High Chief Obi Anoliefo, and Hon. Eze Nwauwa. Onanuga noted that the meeting was a reunion of sorts for President Tinubu, who served in the National Assembly during the aborted Third Republic.