SUNTRUST BANK EXECUTIVES ARRAIGNED OVER $12 MILLION MONEY LAUNDERING CHARGES

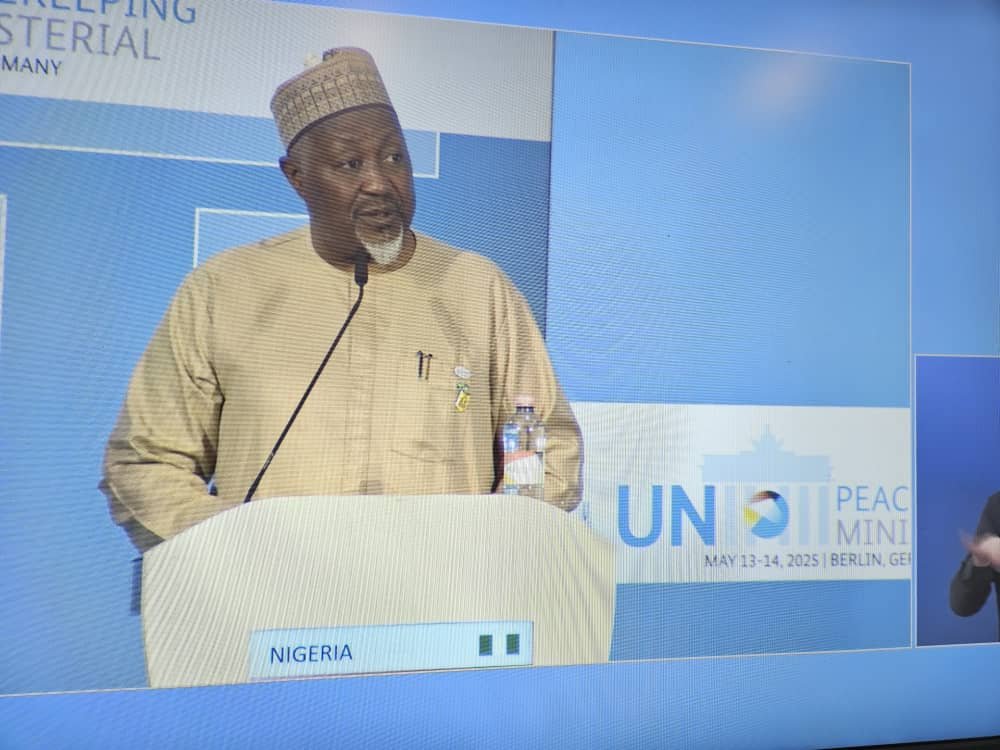

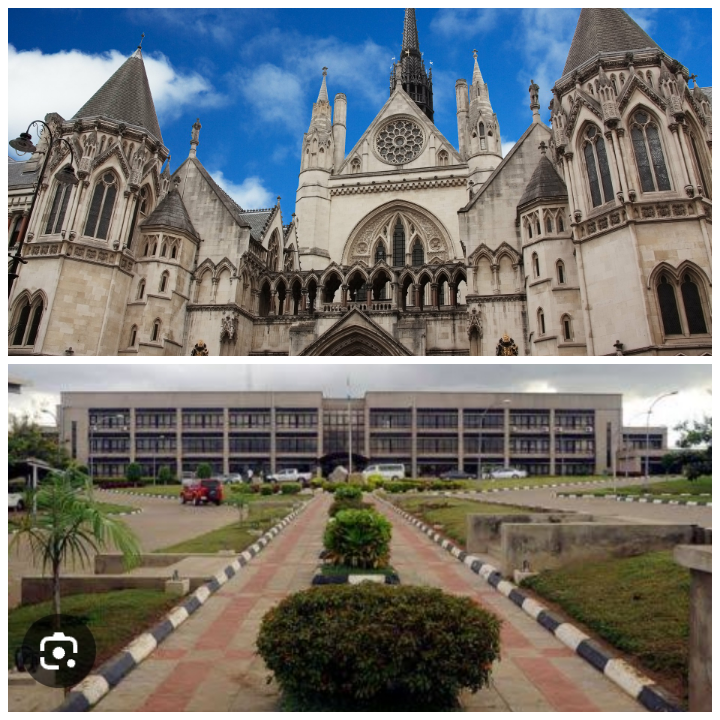

The Economic and Financial Crimes Commission (EFCC) has arraigned Halima Buba, Managing Director and Chief Executive Officer of SunTrust Bank Ltd, and Innocent Mbagwu, Executive Director and Chief Compliance Officer, before Justice Emeka Nwite of the Federal High Court in Abuja. The duo faces a six-count charge bordering on money laundering to the tune of $12 million. According to the charges, Buba and Mbagwu allegedly aided Femi Gbamgboye to make a cash payment of $3 million to Suleiman Muhammed Chiroma and associates without going through a financial institution on March 10, 2025, in Abuja. Another charge accuses them of conspiring to make a similar cash payment of $3 million to Mukhtar Miko, an associate of Chiroma, on March 13, 2025, in Lagos. When the charges were read, both defendants pleaded not guilty. Lead prosecution counsel Rotimi Oyedepo, SAN, expressed the prosecution’s readiness to proceed with the trial and prayed for an accelerated hearing. Defence counsel J.J. Usman, SAN, urged the court to grant bail, citing existing applications filed on May 27, 2025. However, Oyedepo opposed the bail application, describing it as “incompetent” since the defendants were neither under arrest nor detention when they filed the application. “The prosecution counsel in his response, described the May 27, 2025 bail application of the defendants as incompetent, given that the defendants were neither under arrest, nor in detention, nor have appeared before the court,” he said. Justice Nwite admitted the defendants to bail in the sum of N100 million each, with one surety each in like sum. The sureties must own landed properties in Abuja, and their documents and residences must be verified by the court before approval. Until the bail conditions are met, the defendants will be remanded in a correctional facility. The court adjourned the matter to July 17 and 18 for continuation of trial. The EFCC’s action marks a significant development in its efforts to clamp down on corporate financial misconduct involving top banking executives.