-

CapitalTimesNews / 3 months

- 0

- 3 min read

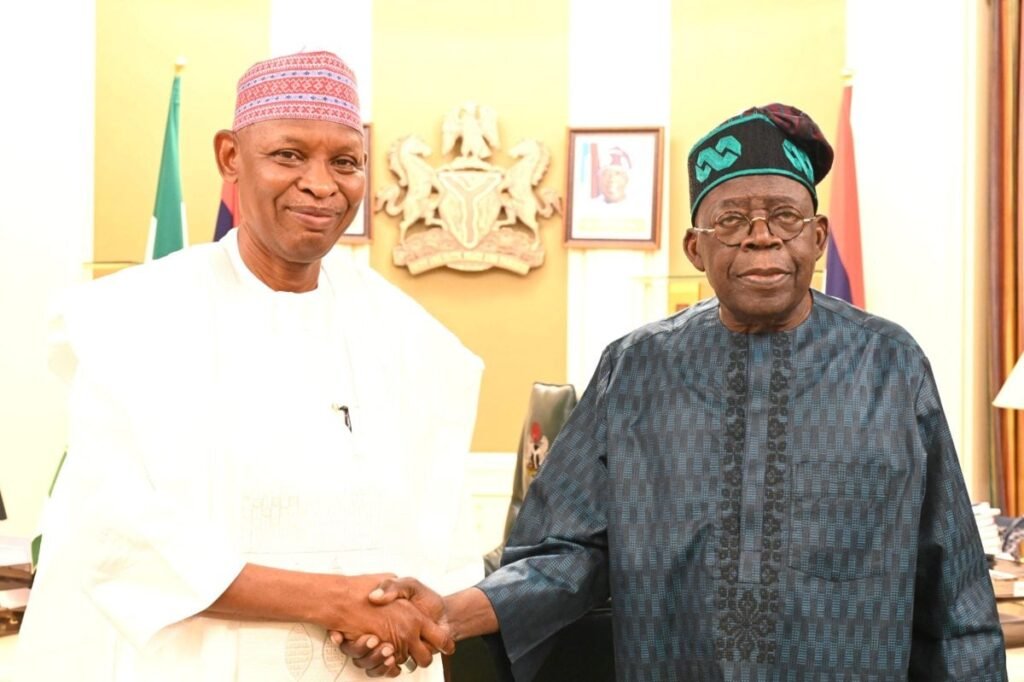

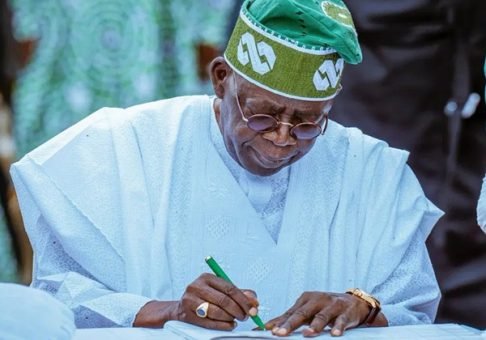

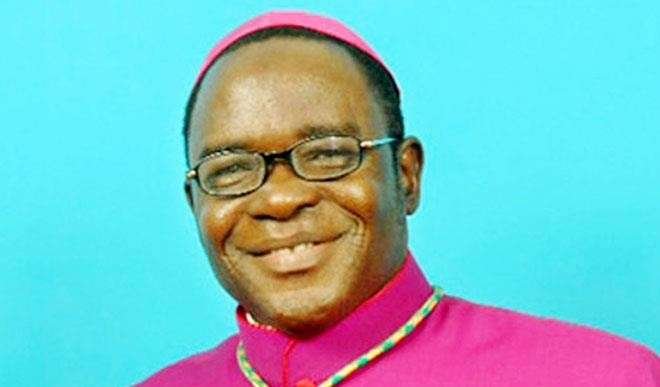

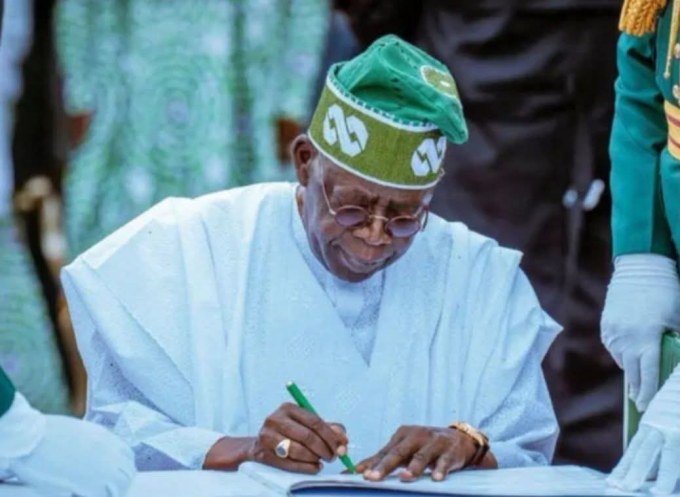

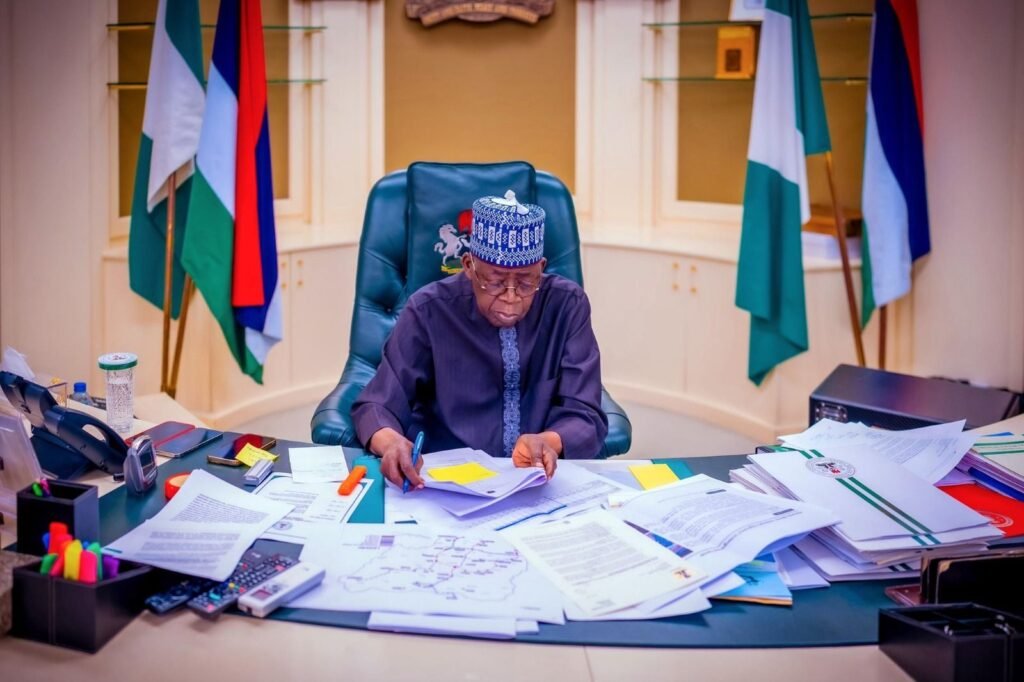

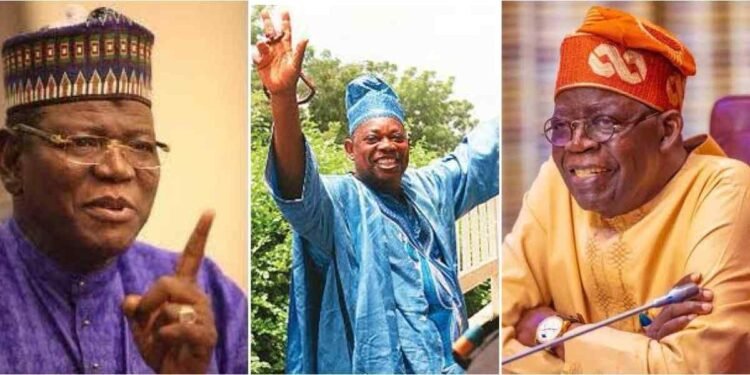

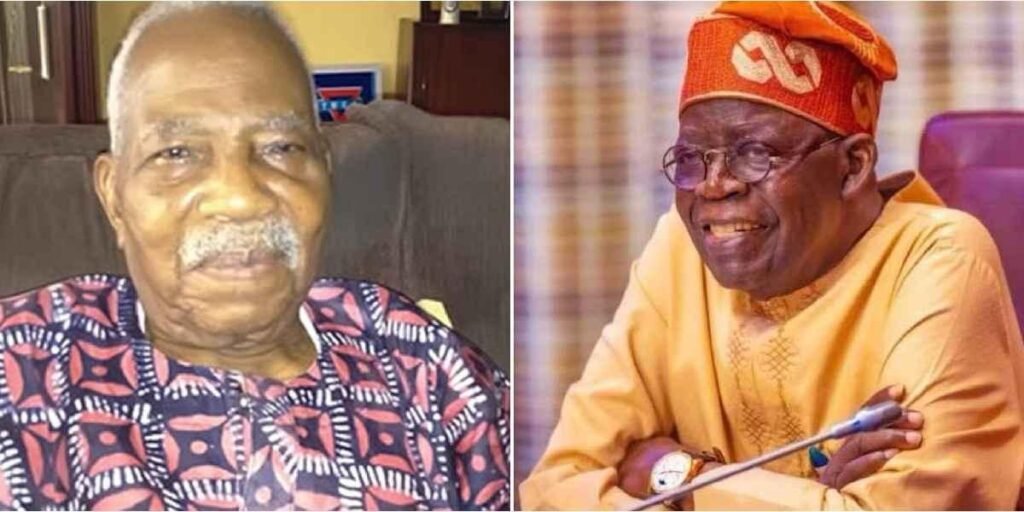

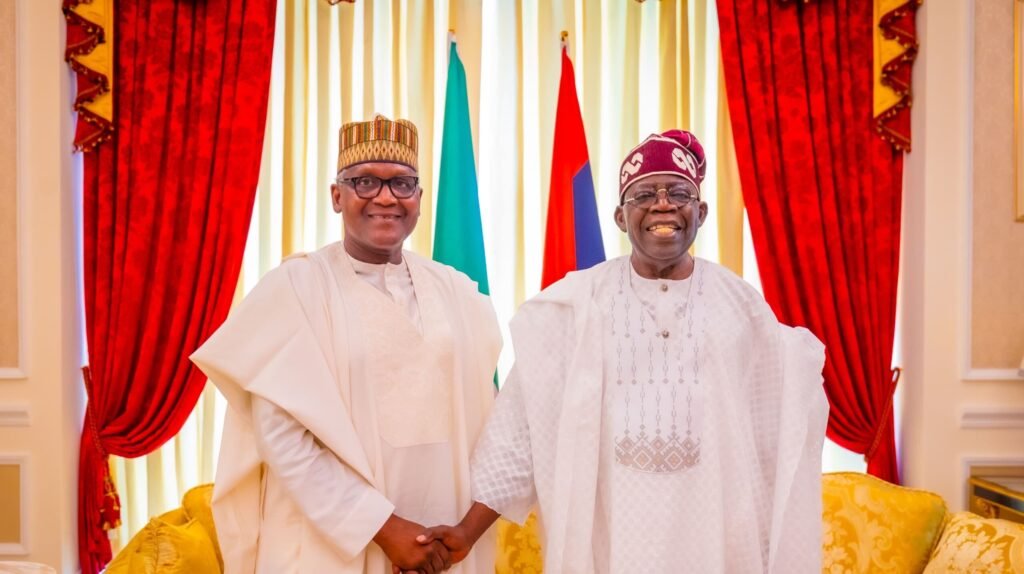

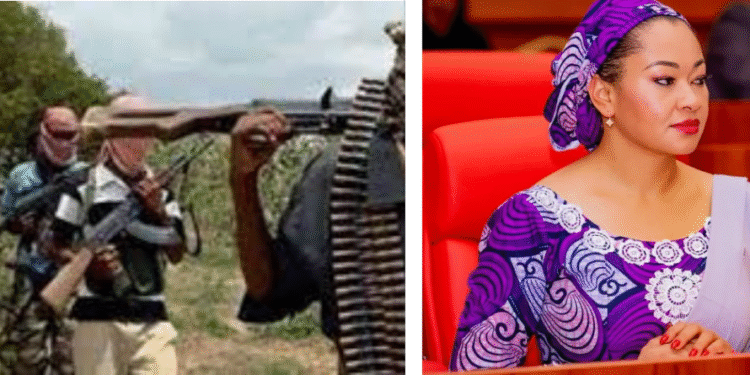

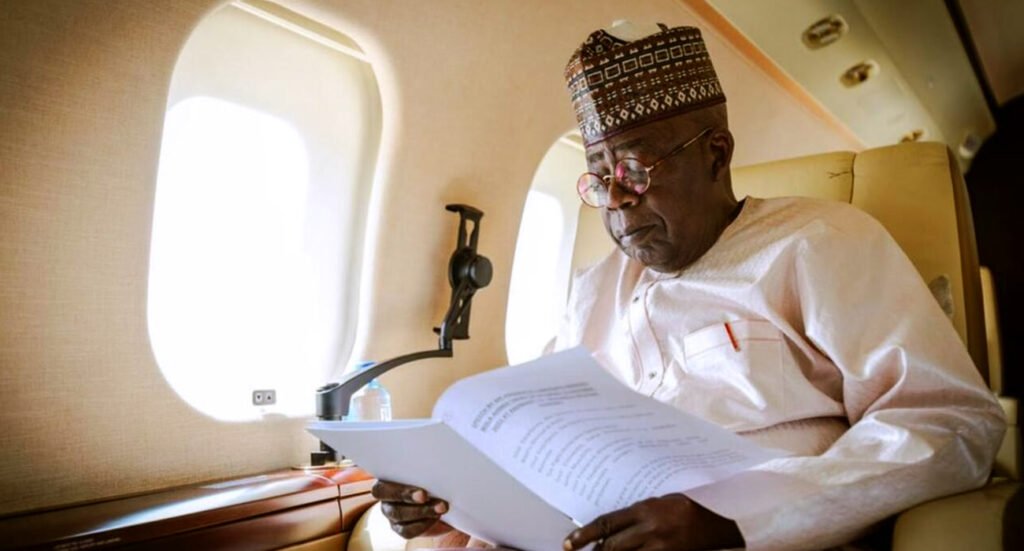

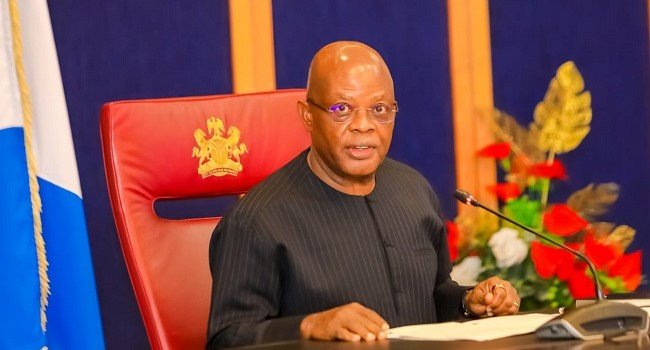

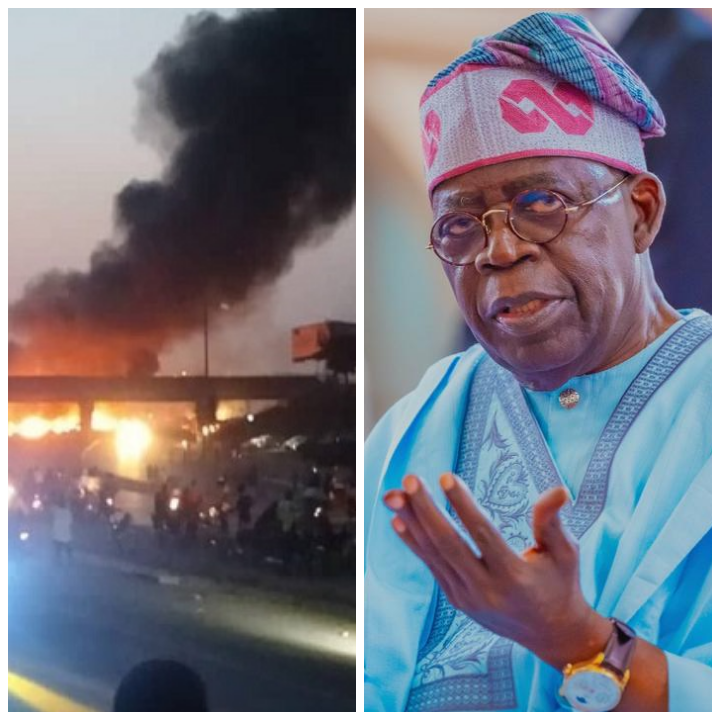

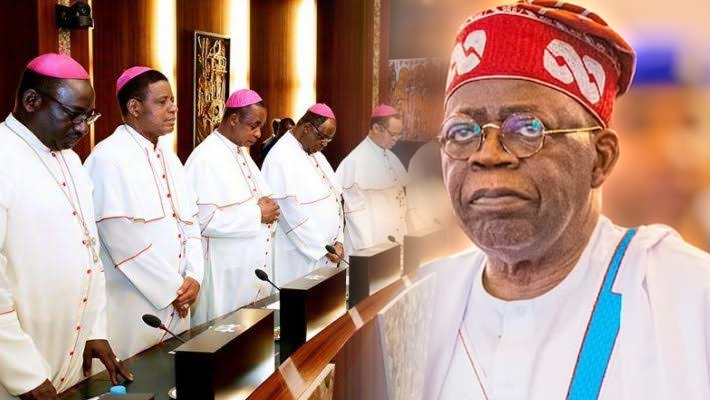

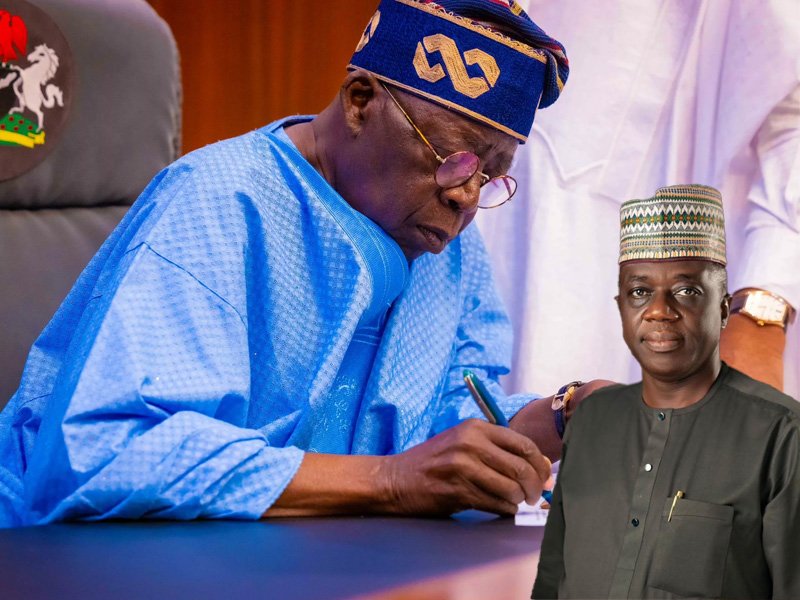

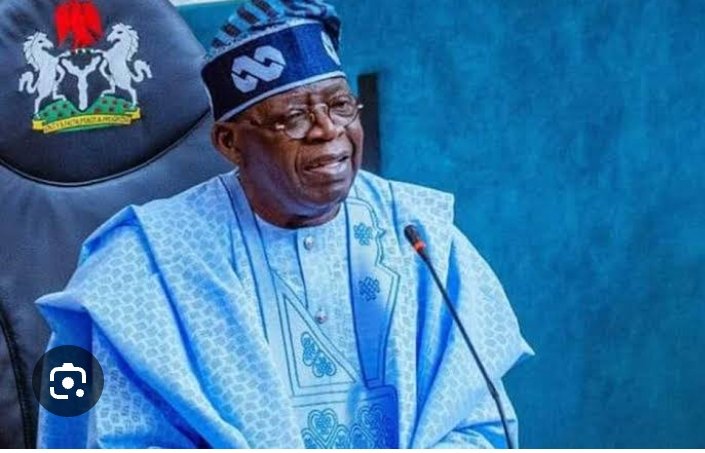

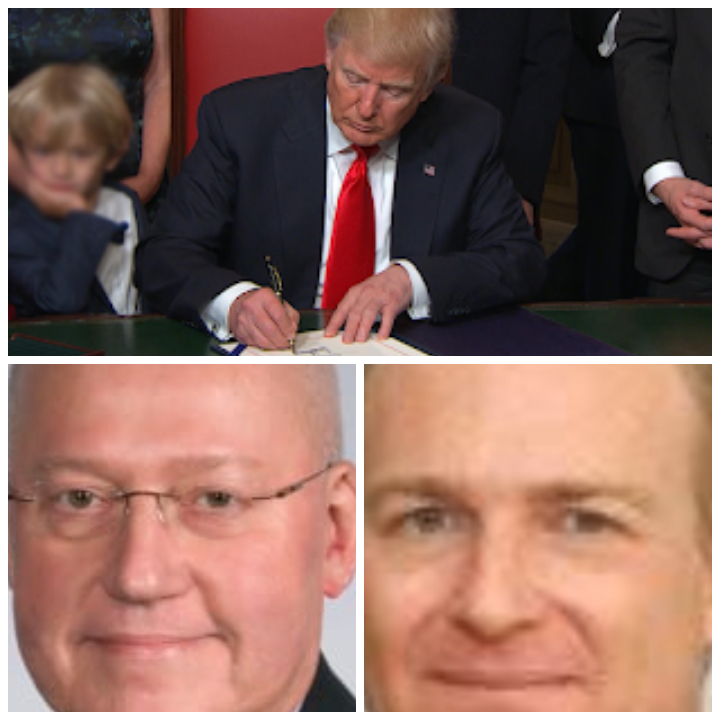

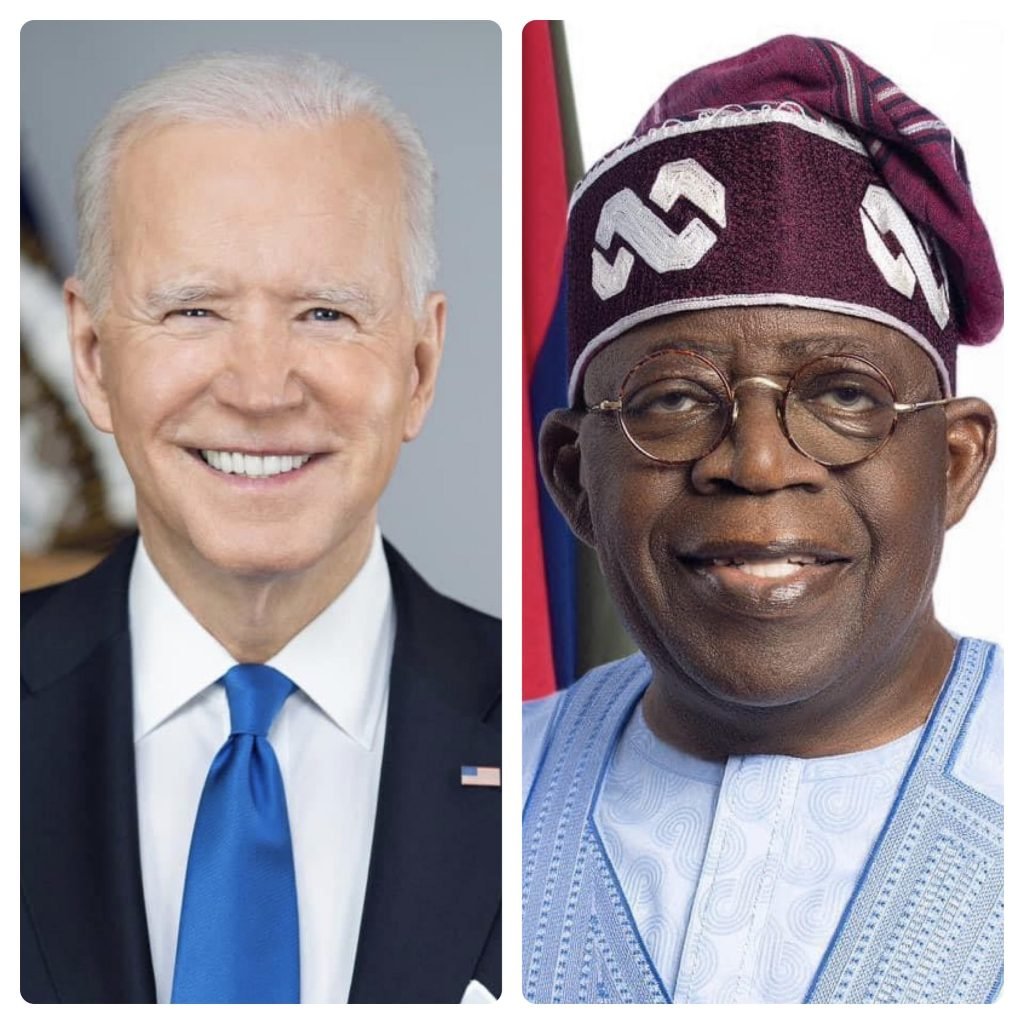

The United States House of Representatives Subcommittee on Africa will hold a public hearing on Thursday, November 20, 2025, to scrutinize President Donald Trump’s decision to return Nigeria to the list of Countries of Particular Concern, or CPC, over allegations of religious freedom violations. The session will be chaired by Representative Chris Smith, a Republican from New Jersey, who is a long-time advocate on global religious liberty issues. The hearing will convene in Room 2172 of the Rayburn House Office Building at 11 a.m. and will be streamed live online. According to an invitation, the hearing will feature two panels. The first panel will include senior State Department officials Jonathan Pratt, the Senior Bureau Official for African Affairs, and Jacob McGee, Deputy Assistant Secretary in the Bureau of Democracy, Human Rights, and Labor. A second panel will include witnesses from religious and policy organizations, such as Nina Shea, Director of the Centre for Religious Freedom; Bishop Wilfred Anagbe of the Makurdi Catholic Diocese; and Oge Onubogu of the Centre for Strategic and International Studies. The review will assess the scale of religious persecution in Nigeria and explore potential U.S. responses, which could range from targeted sanctions and withholding aid to increased cooperation with Nigerian authorities. President Trump reignited the debate on October 31, 2025, when he redesignated Nigeria as a CPC, a move that paves the way for punitive measures. In a statement the following day, he alleged that Christians in Nigeria were facing an “existential threat,” claiming thousands had been killed by Islamist extremists. “If the Nigerian Government continues to allow the killing of Christians, the USA will immediately stop all aid and assistance to Nigeria,” Trump warned. “We may very well go into that country ‘guns-a-blazing’ to completely wipe out the terrorists committing these atrocities.” He also directed the U.S. “Department of War” to prepare for a possible intervention, describing any potential strike as “fast, vicious, and sweet.” Nigerian President Bola Tinubu rejected this portrayal. In a statement on social media, Tinubu said the characterization “does not reflect our national reality,” insisting that Nigeria remains committed to constitutional protections of religious liberty. “Religious freedom and tolerance have been a core tenet of our collective identity,” he said. The CPC designation has refocused global attention on years of violent attacks against Christian communities in Nigeria’s northern and central states. Bishop Anagbe, one of the scheduled witnesses, has previously detailed sustained attacks on Christian communities in Benue State, describing how displaced families fled to camps after their villages were overrun. Republican lawmakers are intensifying pressure. Representative Riley Moore, a Republican from West Virginia, stated in a recent interview that congressional committees are already reviewing the situation. “What is going on there is horrific, these killings of brothers and sisters in Christ,” Moore said. He countered President Tinubu’s dismissal, stating that religious persecution is “a serious and ongoing reality.” Moore also claimed that Christians in Nigeria are being killed at a ratio of “five to one” compared to Muslims. “We are a Christian nation and we stand up for the persecuted,” Moore insisted. “The CPC designation unlocks different tools, sanctions, withholding development funds, restricting financing. And yes, military options remain on the table.” A companion bill to solidify the designation has also been sponsored in the Senate by Senator Ted Cruz.