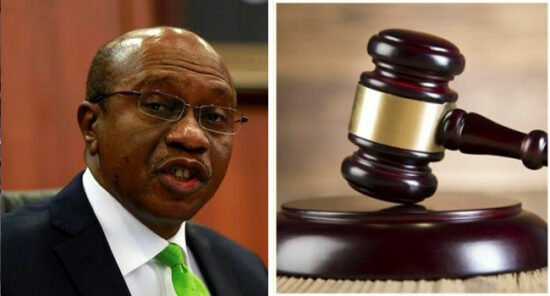

CBN limits daily transaction for PoS agents to promote cashless economy By Nicolas Adekeye

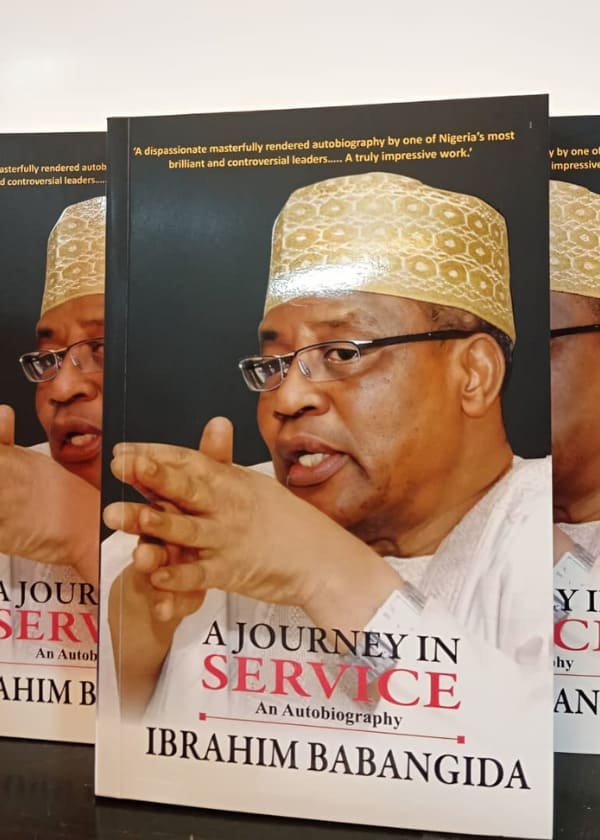

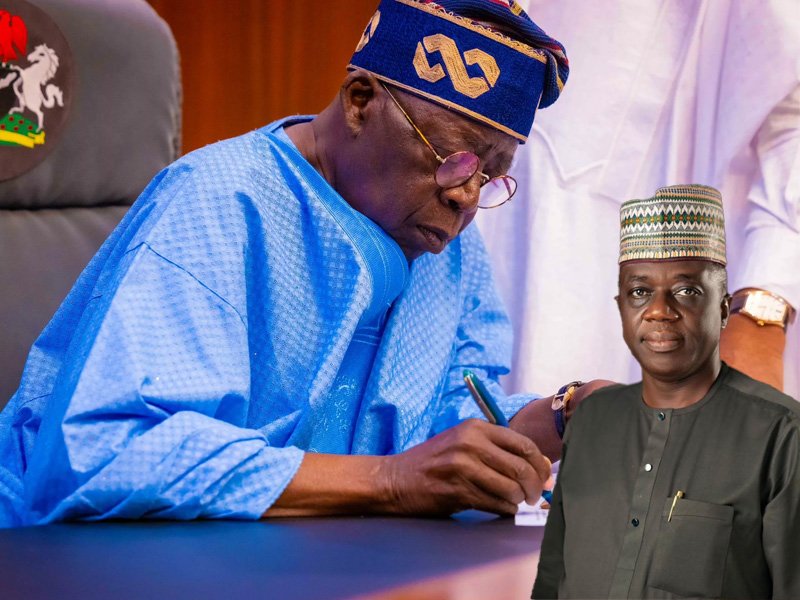

The Central Bank of Nigeria (CBN) has announced a new daily transaction limit for Point of Sales (PoS) agents, restricting cash-outs to a maximum of N1.2 million. This policy is part of the apex bank’s continued efforts to promote a cashless economy and enhance electronic payment systems.According to the CBN, the new policy is aimed at streamlining agency banking operations through electronic channels. The circular titled: “Cash-Out limits for agent banking transactions,” was signed by Oladimeji Yisa Taiwo, for the Director of Payments System Management Department.As of July 2024, Nigeria had 3.05 million PoS devices deployed across the country, with a total of 4.06 million registered terminals, according to the Nigeria Interbank Settlement System (NIBSS).In addition to the PoS transaction limits, the CBN also set a weekly withdrawal cap for individual customers at N500, 000, regardless of the transaction channel. Each PoS terminal will now have a daily maximum cash-out limit of N100, 000 per customer, with a cumulative daily transaction limit of N1.2 million per agent.The CBN emphasized the importance of leveraging technology to streamline transactions, adding that “the bank hereby releases the following policy interventions, which have become necessary to enhance the use of electronic payment channels for agency banking operations.” The new policy is expected to promote a cashless economy and enhance electronic payment systems. However, it may pose challenges for POS operators who rely on high-volume transactions to sustain their businesses. Customers may also face inconveniences due to the reduced cash availability, particularly in rural areas with limited access to banks.The CBN has urged stakeholders to adhere to the guidelines and contribute to the realization of a more robust and cashless financial system in Nigeria. The apex bank said it will conduct periodic oversight, including backend configuration checks, to ensure compliance. Violations of the directive will result in penalties, including monetary fines and administrative sanctions.