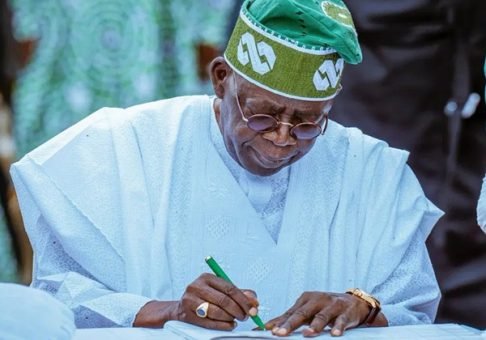

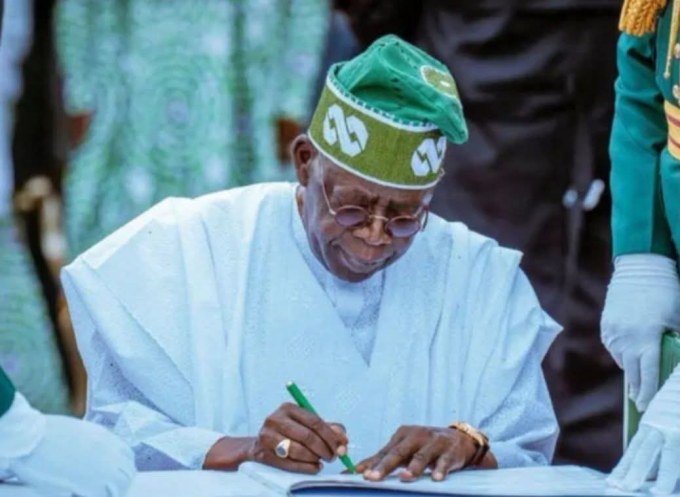

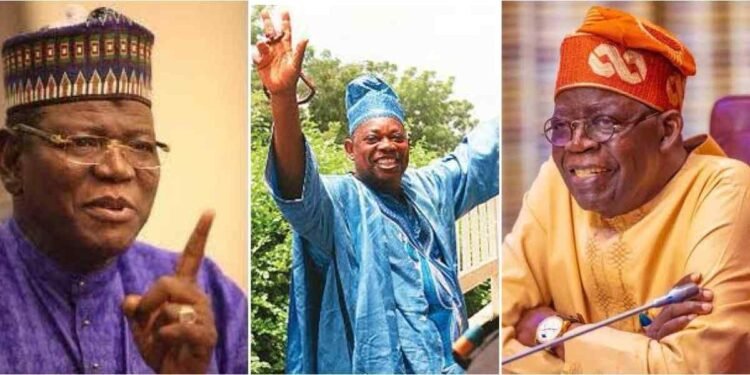

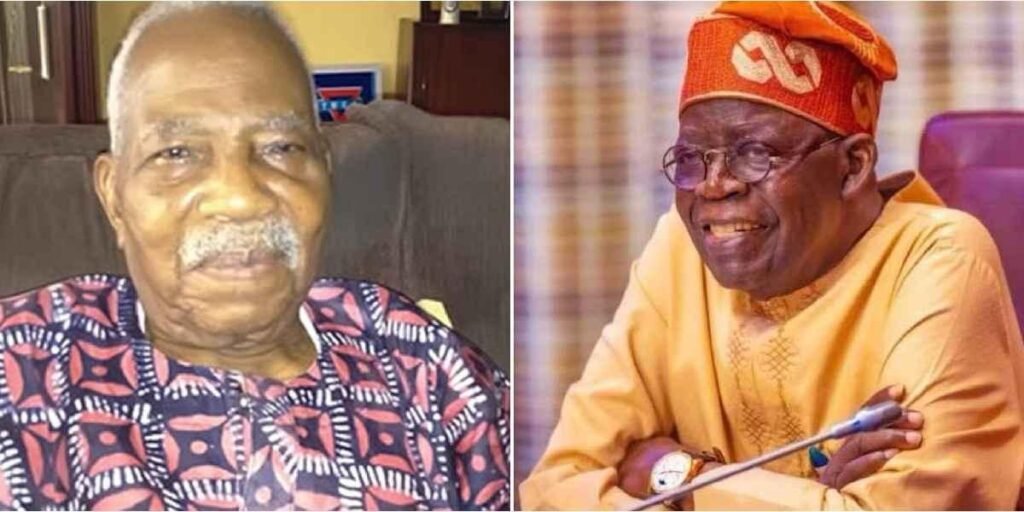

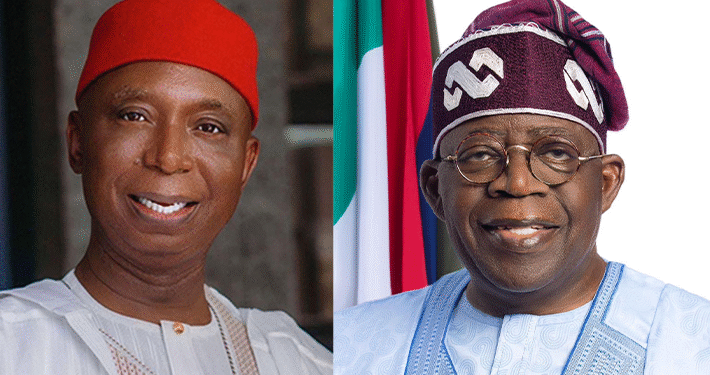

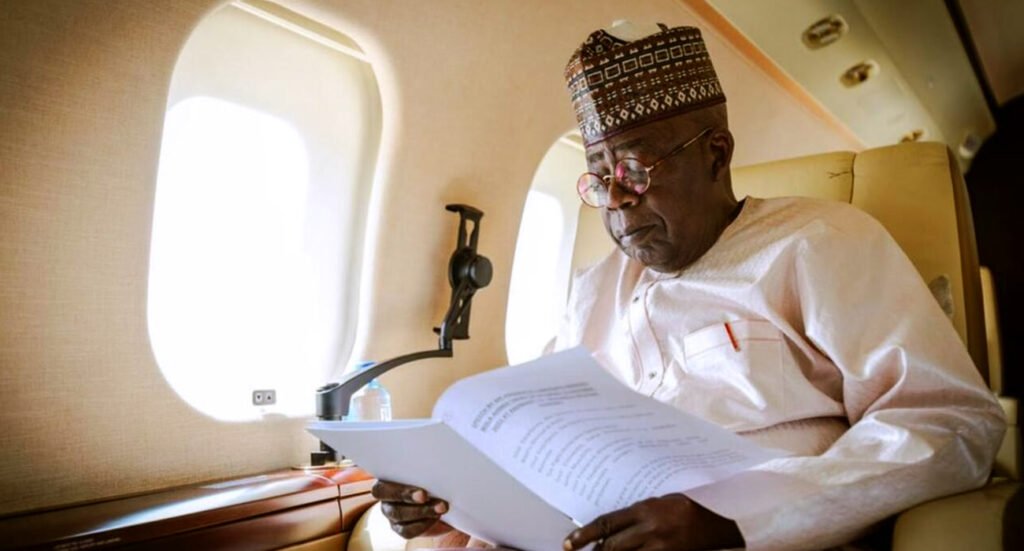

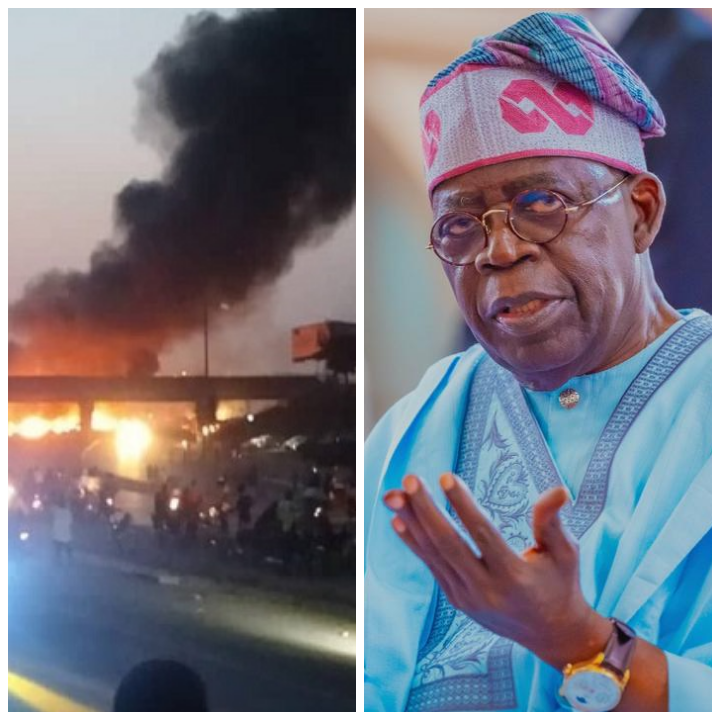

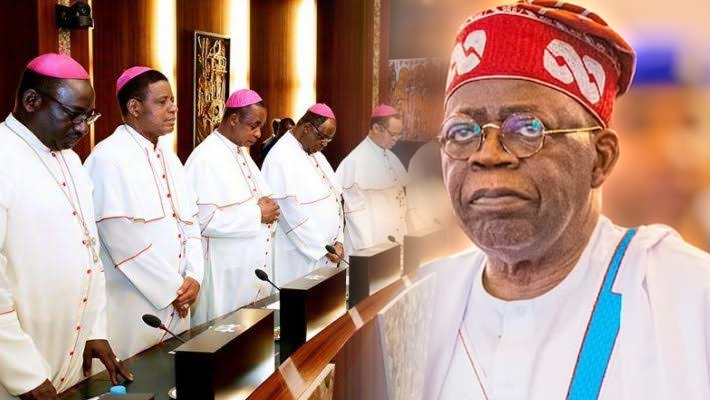

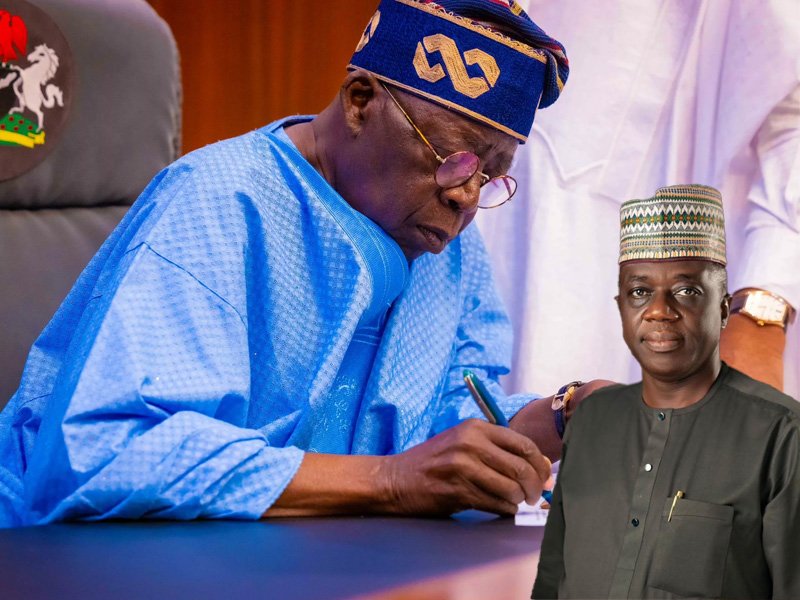

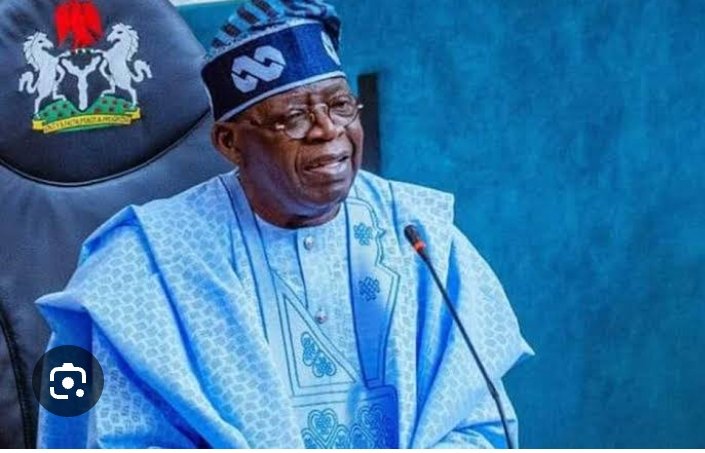

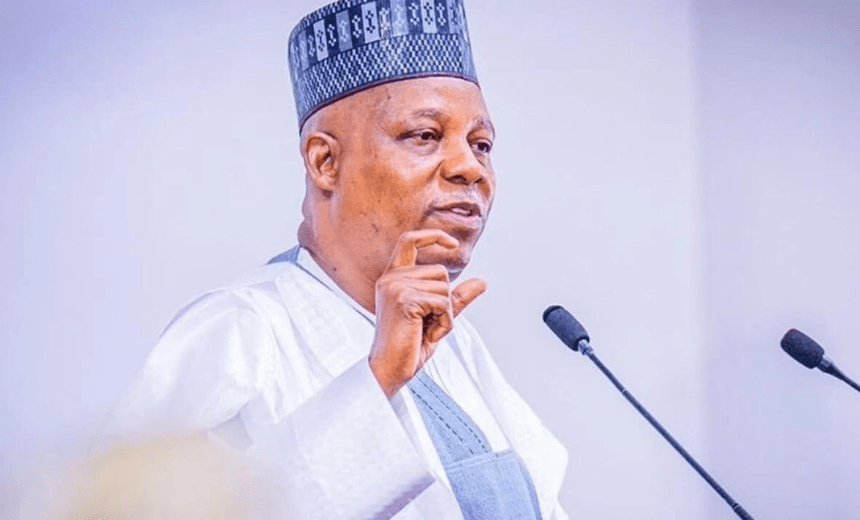

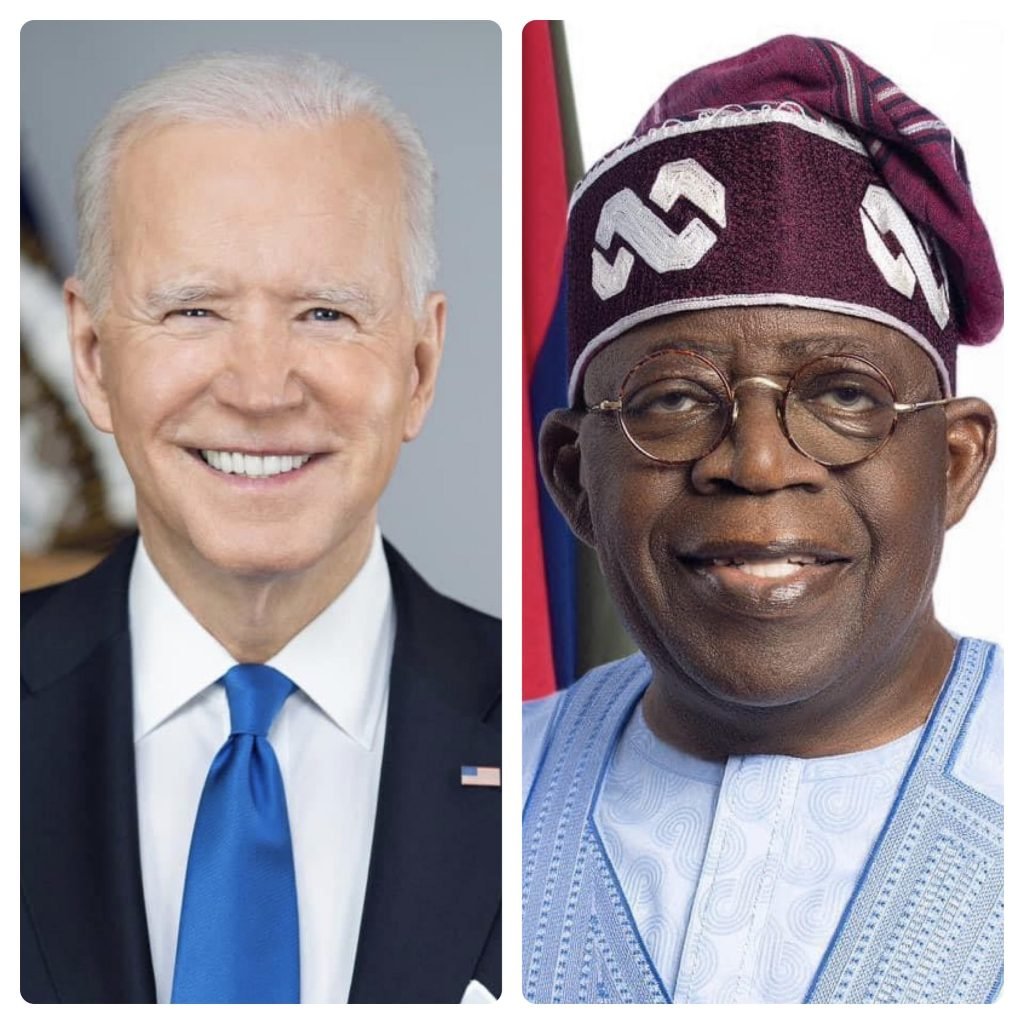

NIGERIA EXEMPTS LOW-INCOME EARNERS FROM TAXES AS PRESIDENT TINUBU SIGNS NEW TAX LAWS

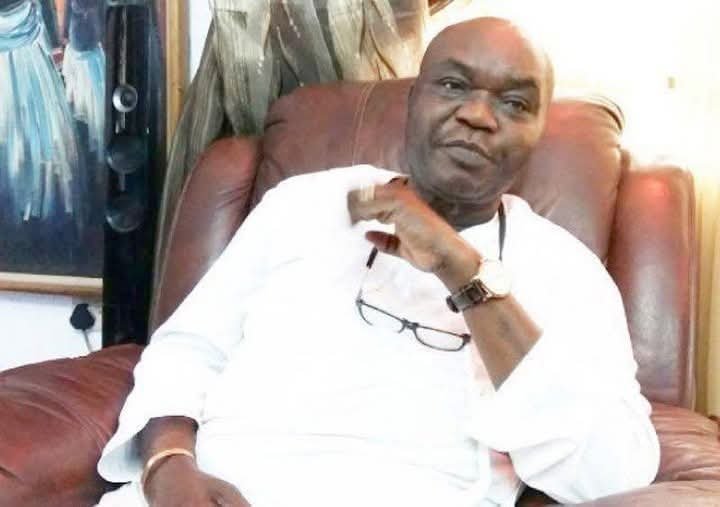

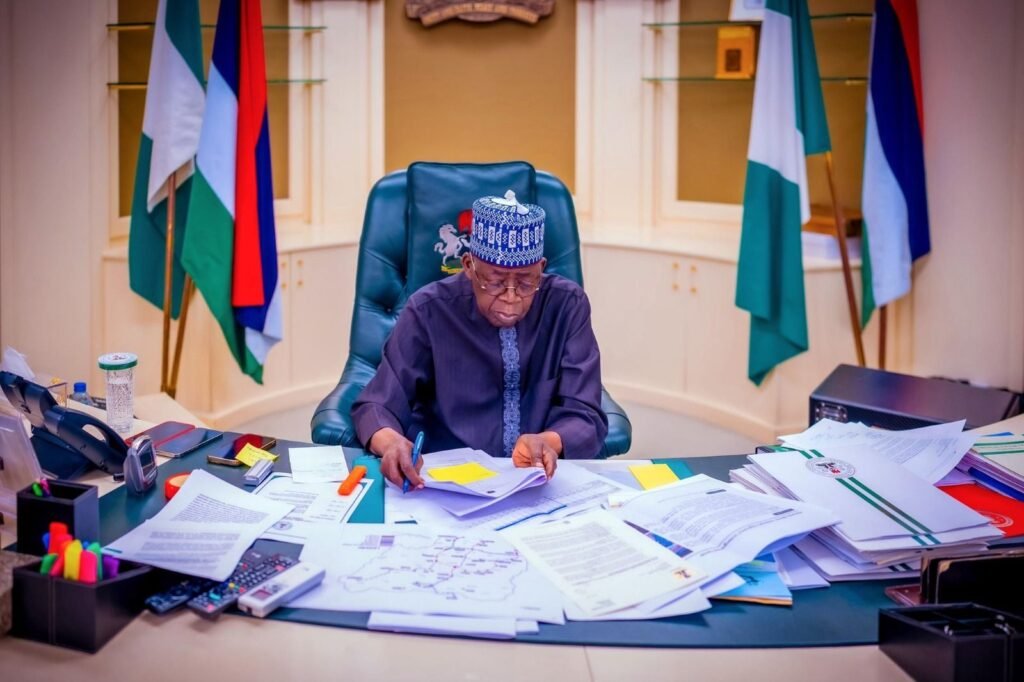

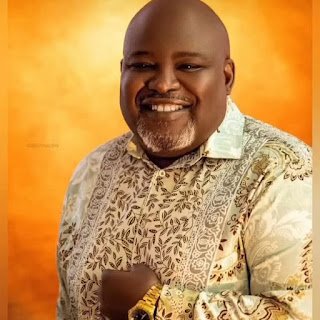

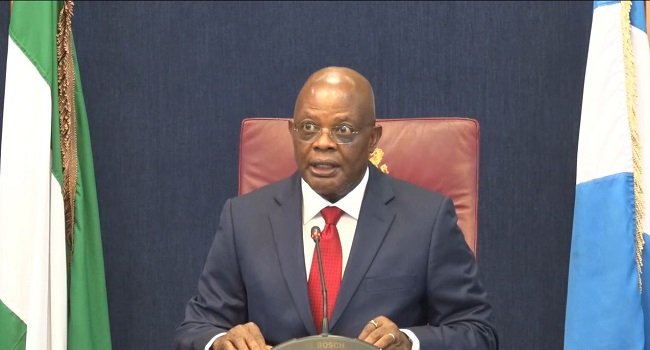

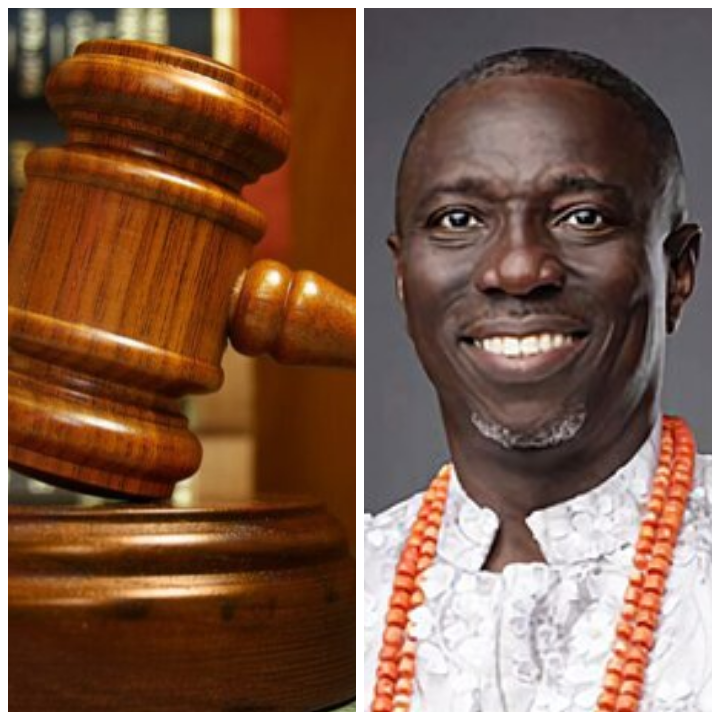

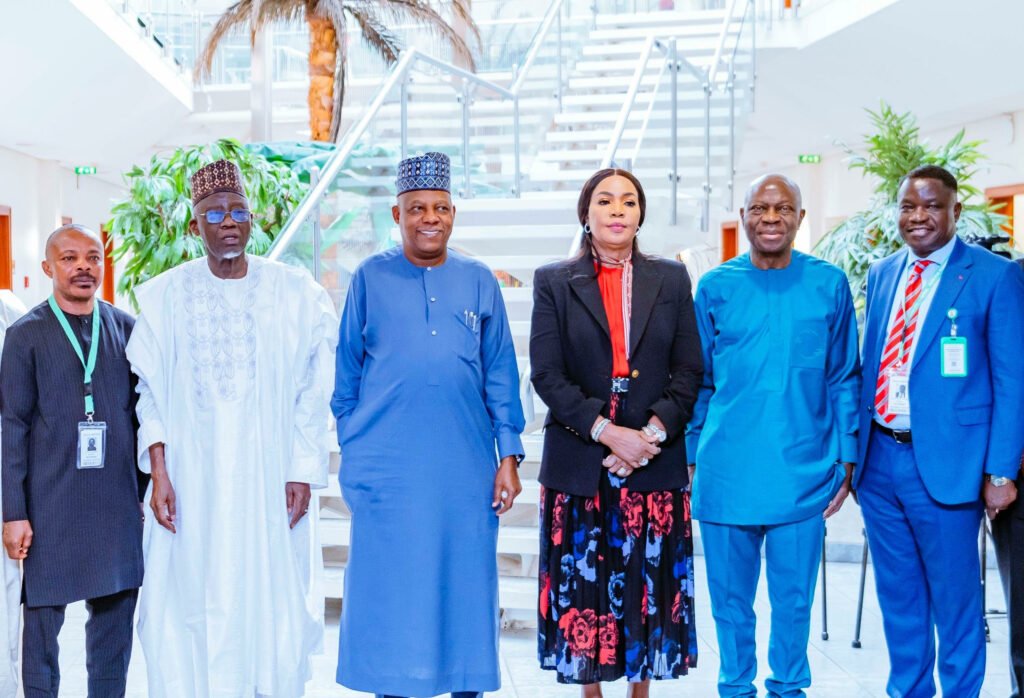

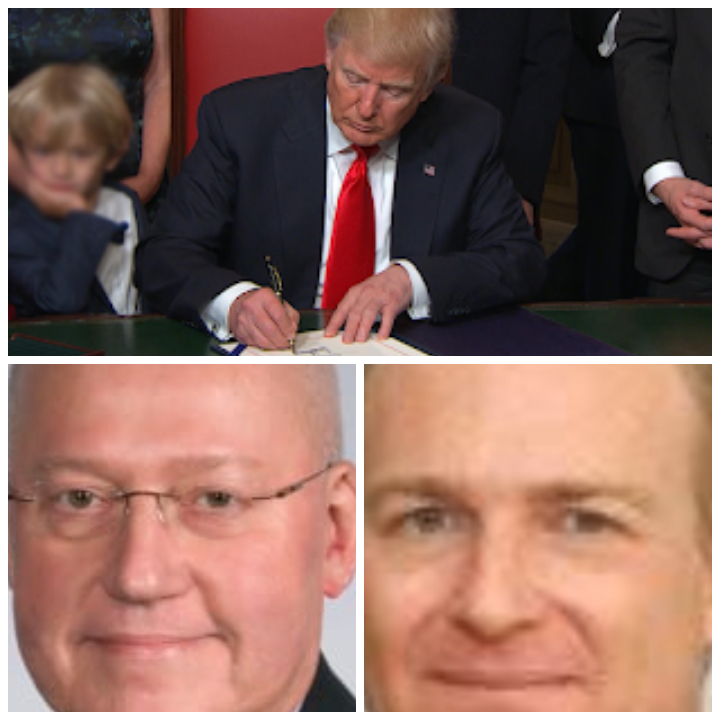

Nigeria’s President Bola Tinubu has signed four new tax bills into law, exempting individuals earning below ₦250,000 monthly from paying taxes. According to Taiwo Oyedele, Chairman of the Presidential Committee on Fiscal Policy and Tax Reforms, households earning this amount or less are now officially classified as poor. “We’ve removed the tax burden for those at the bottom, reduced it for the middle class, and slightly increased it for the top earners,” Oyedele stated. He added that households earning between ₦1.8 million and ₦2 million monthly would see a tax reduction, not elimination, and represent about five percent of Nigeria’s population. The new laws, effective January 2026, aim to stimulate economic activity and curb tax evasion. Oyedele explained that the committee defined the poverty line based on national realities rather than solely on World Bank or UN benchmarks. “We considered that many Nigerians don’t earn $2.15 daily but still survive by producing their own food or avoiding transport costs. I lived in the village—I know how that works.” According to Oyedele, a five-person household supported by two earners would require ₦250,000 per month to provide for basic needs without luxury. “Such families are poor,” he said, “and should not be taxed.” Oyedele emphasized that the reforms would ensure the government doesn’t take money from the poor, stating, “These laws won’t put money in your pocket, but they’ll ensure the government doesn’t take it from you if you’re poor.” The committee also noted that Nigeria currently collects only 30% of its potential tax revenue, and the goal of the reforms is to close the remaining 70% gap through fairer, more efficient systems.