CBN FACES LEGAL ACTION OVER ATM TRANSACTION FEE HIKE

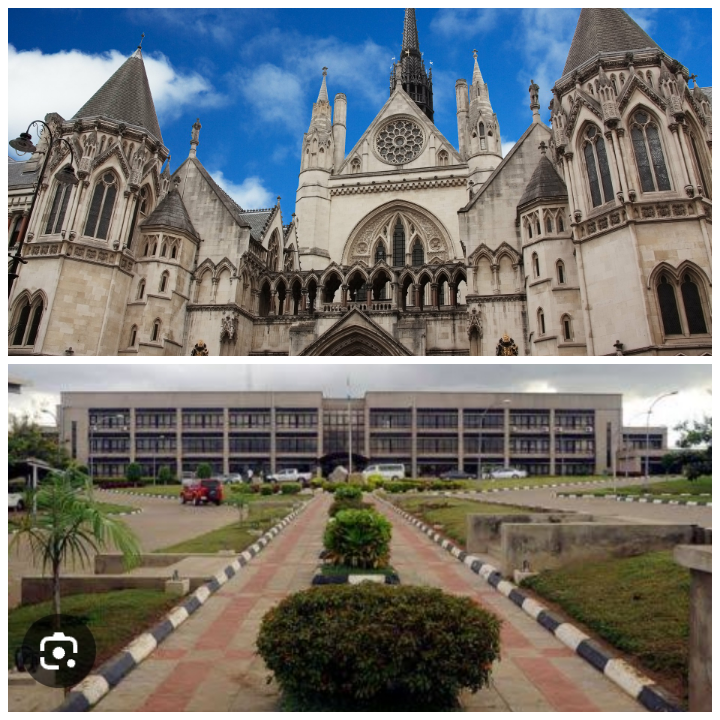

The Socio-Economic Rights and Accountability Project (SERAP) has initiated a lawsuit against the Central Bank of Nigeria (CBN) over the recent increase in Automated Teller Machine (ATM) transaction fees. The CBN’s new policy, which took effect recently, charges N100 for every N20,000 withdrawn from bank-owned ATMs outside their branch premises. Additionally, withdrawals at shopping centers, airports, and standalone cash points attract a N100 charge, plus a surcharge of up to N500. SERAP argues that the CBN’s decision is arbitrary and violates the Federal Competition and Consumer Protection Act of 2018. The organization is seeking a declaration from the court that the fee increase is unjust and contrary to the provisions of the law. SERAP is also requesting an interim injunction to prevent the CBN and its associates from enforcing the new fees while the case is under review. According to SERAP, the increase disproportionately affects economically disadvantaged Nigerians and creates an unfair two-tiered financial system. The organization contends that the CBN’s actions compromise its mission to manage the economy effectively and uphold human rights. SERAP emphasizes that the burden of the fee hike should have been borne by banks and their shareholders, rather than the general public. “The increase in ATM transaction fees ought to have been shouldered by wealthy banks and their shareholders, not the general public,” SERAP stated in the lawsuit. “CBN policies should not be skewed against poor Nigerians and heavily in favour of banks that continue to declare trillions of naira in profits mostly at the expense of their customers”. The case, filed at the Federal High Court in Lagos with case number FHC/L/CS/344/2025, is awaiting a hearing date.